Page 221 - Grapevine FY19 Operating Budget

P. 221

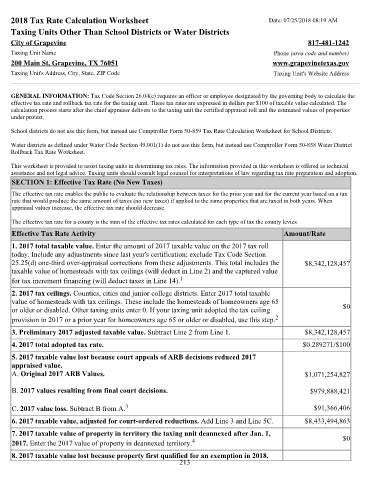

2018 Tax Rate Calculation Worksheet Date: 07/25/2018 08:19 AM

Taxing Units Other Than School Districts or Water Districts

City of Grapevine 817-481-1242

Taxing Unit Name Phone (area code and number)

200 Main St, Grapevine, TX 76051 www.grapevinetexas.gov

Taxing Unit's Address, City, State, ZIP Code Taxing Unit's Website Address

GENERAL INFORMATION: Tax Code Section 26.04(c) requires an officer or employee designated by the governing body to calculate the

effective tax rate and rollback tax rate for the taxing unit. These tax rates are expressed in dollars per $100 of taxable value calculated. The

calculation process starts after the chief appraiser delivers to the taxing unit the certified appraisal roll and the estimated values of properties

under protest.

School districts do not use this form, but instead use Comptroller Form 50-859 Tax Rate Calculation Worksheet for School Districts.

Water districts as defined under Water Code Section 49.001(1) do not use this form, but instead use Comptroller Form 50-858 Water District

Rollback Tax Rate Worksheet.

This worksheet is provided to assist taxing units in determining tax rates. The information provided in this worksheet is offered as technical

assistance and not legal advice. Taxing units should consult legal counsel for interpretations of law regarding tax rate preparation and adoption.

SECTION 1: Effective Tax Rate (No New Taxes)

The effective tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year based on a tax

rate that would produce the same amount of taxes (no new taxes) if applied to the same properties that are taxed in both years. When

appraisal values increase, the effective tax rate should decrease.

The effective tax rate for a county is the sum of the effective tax rates calculated for each type of tax the county levies.

Effective Tax Rate Activity Amount/Rate

1. 2017 total taxable value. Enter the amount of 2017 taxable value on the 2017 tax roll

today. Include any adjustments since last year's certification; exclude Tax Code Section

25.25(d) one-third over-appraisal corrections from these adjustments. This total includes the $8,342,128,457

taxable value of homesteads with tax ceilings (will deduct in Line 2) and the captured value

for tax increment financing (will deduct taxes in Line 14). 1

2. 2017 tax ceilings. Counties, cities and junior college districts. Enter 2017 total taxable

value of homesteads with tax ceilings. These include the homesteads of homeowners age 65

or older or disabled. Other taxing units enter 0. If your taxing unit adopted the tax ceiling $0

provision in 2017 or a prior year for homeowners age 65 or older or disabled, use this step. 2

3. Preliminary 2017 adjusted taxable value. Subtract Line 2 from Line 1. $8,342,128,457

4. 2017 total adopted tax rate. $0.289271/$100

5. 2017 taxable value lost because court appeals of ARB decisions reduced 2017

appraised value.

A. Original 2017 ARB Values. $1,071,254,827

B. 2017 values resulting from final court decisions. $979,888,421

3

C. 2017 value loss. Subtract B from A. $91,366,406

6. 2017 taxable value, adjusted for court-ordered reductions. Add Line 3 and Line 5C. $8,433,494,863

7. 2017 taxable value of property in territory the taxing unit deannexed after Jan. 1, $0

2017. Enter the 2017 value of property in deannexed territory. 4

8. 2017 taxable value lost because property first qualified for an exemption in 2018.

213