Page 161 - Fort Worth City Budget 2019

P. 161

Debt Service Funds

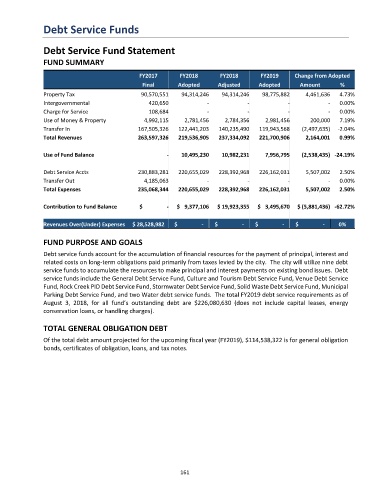

Debt Service Fund Statement

FUND SUMMARY

FY2017 FY2018 FY2018 FY2019 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 90,570,551 94,314,246 94,314,246 98,775,882 4,461,636 4.73%

Intergovernmental 420,650 - - - - 0.00%

Charge for Service 108,684 - - - - 0.00%

Use of Money & Property 4,992,115 2,781,456 2,784,356 2,981,456 200,000 7.19%

Transfer In 167,505,326 122,441,203 140,235,490 119,943,568 (2,497,635) -2.04%

Total Revenues 263,597,326 219,536,905 237,334,092 221,700,906 2,164,001 0.99%

Use of Fund Balance - 10,495,230 10,982,231 7,956,795 (2,538,435) -24.19%

Debt Service Accts 230,883,281 220,655,029 228,392,968 226,162,031 5,507,002 2.50%

Transfer Out 4,185,063 - - - - 0.00%

Total Expenses 235,068,344 220,655,029 228,392,968 226,162,031 5,507,002 2.50%

Contribution to Fund Balance $ - $ 9,377,106 $ 19,923,355 $ 3,495,670 $ (5,881,436) -62.72%

Revenues Over(Under) Expenses $ 28,528,982 $ - $ - $ - $ - 0%

FUND PURPOSE AND GOALS

Debt service funds account for the accumulation of financial resources for the payment of principal, interest and

related costs on long-term obligations paid primarily from taxes levied by the city. The city will utilize nine debt

service funds to accumulate the resources to make principal and interest payments on existing bond issues. Debt

service funds include the General Debt Service Fund, Culture and Tourism Debt Service Fund, Venue Debt Service

Fund, Rock Creek PID Debt Service Fund, Stormwater Debt Service Fund, Solid Waste Debt Service Fund, Municipal

Parking Debt Service Fund, and two Water debt service funds. The total FY2019 debt service requirements as of

August 3, 2018, for all fund’s outstanding debt are $226,080,630 (does not include capital leases, energy

conservation loans, or handling charges).

TOTAL GENERAL OBLIGATION DEBT

Of the total debt amount projected for the upcoming fiscal year (FY2019), $114,538,322 is for general obligation

bonds, certificates of obligation, loans, and tax notes.

161