Page 163 - Fort Worth City Budget 2019

P. 163

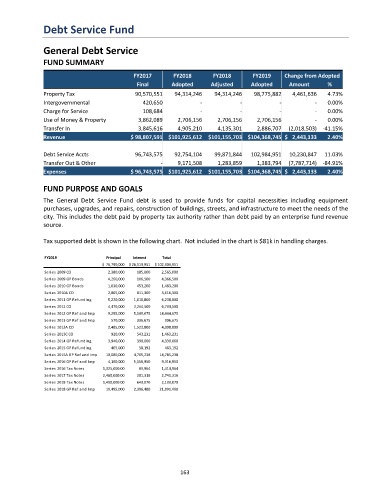

Debt Service Fund

General Debt Service

FUND SUMMARY

FY2017 FY2018 FY2018 FY2019 Change from Adopted

Final Adopted Adjusted Adopted Amount %

Property Tax 90,570,551 94,314,246 94,314,246 98,775,882 4,461,636 4.73%

Intergovernmental 420,650 - - - - 0.00%

Charge for Service 108,684 - - - - 0.00%

Use of Money & Property 3,862,089 2,706,156 2,706,156 2,706,156 - 0.00%

Transfer In 3,845,616 4,905,210 4,135,301 2,886,707 (2,018,503) -41.15%

Revenue $ 98,807,591 $101,925,612 $101,155,703 $104,368,745 $ 2,443,133 2.40%

Debt Service Accts 96,743,575 92,754,104 99,871,844 102,984,951 10,230,847 11.03%

Transfer Out & Other - 9,171,508 1,283,859 1,383,794 (7,787,714) -84.91%

Expenses $ 96,743,575 $101,925,612 $101,155,703 $104,368,745 $ 2,443,133 2.40%

FUND PURPOSE AND GOALS

The General Debt Service Fund debt is used to provide funds for capital necessities including equipment

purchases, upgrades, and repairs, construction of buildings, streets, and infrastructure to meet the needs of the

city. This includes the debt paid by property tax authority rather than debt paid by an enterprise fund revenue

source.

Tax supported debt is shown in the following chart. Not included in the chart is $81k in handling charges.

FY2019 Principal Interest Total

$ 76,790,000 $ 26,113,951 $ 102,903,951

Series 2009 CO 2,380,000 185,000 2,565,000

Series 2009 GP Bonds 4,260,000 106,500 4,366,500

Series 2010 GP Bonds 1,030,000 453,200 1,483,200

Series 2010A CO 2,805,000 811,300 3,616,300

Series 2011 GP Refunding 5,220,000 1,018,800 6,238,800

Series 2012 CO 4,470,000 2,264,500 6,734,500

Series 2012 GP Ref and Imp 9,295,000 5,149,675 14,444,675

Series 2013 GP Ref and Imp 570,000 336,675 906,675

Series 2013A CO 2,485,000 1,523,800 4,008,800

Series 2013C CO 920,000 543,231 1,463,231

Series 2014 GP Refunding 3,940,000 390,060 4,330,060

Series 2015 GP Refunding 405,000 58,192 463,192

Series 2015A GP Ref and Imp 10,080,000 4,705,238 14,785,238

Series 2016 GP Ref and Imp 4,160,000 5,156,950 9,316,950

Series 2016 Tax Notes 1,325,000.00 89,964 1,414,964

Series 2017 Tax Notes 2,460,000.00 281,316 2,741,316

Series 2018 Tax Notes 1,490,000.00 643,070 2,133,070

Series 2018 GP Ref and Imp 19,495,000 2,396,480 21,891,480

163