Page 55 - Microsoft Word - Budget FY 19

P. 55

CITY OF FOREST HILL

MAJOR REVENUE SOURCES

The major revenue sources for the City include ad valorem (property) taxes, sales tax, franchise taxes,

water and sewer charges, fees and permits and fines and forfeitures. Each of these sources of revenue

plays a vital role in determining the fiscal health of the City.

REVENUE FORECASTING

Revenue forecasts are largely based on trend analysis, with an emphasis on current and expected future

economic conditions with the national, state, and local economy. Any changes in law that might affect

revenue streams must also be considered.

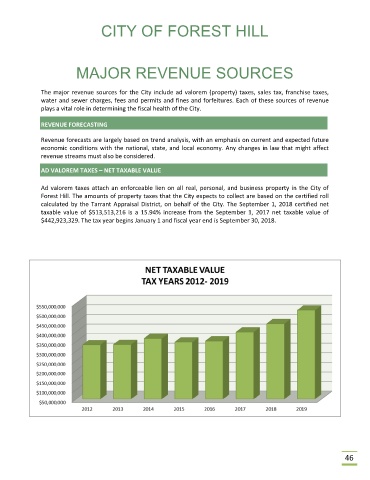

AD VALOREM TAXES – NET TAXABLE VALUE

Ad valorem taxes attach an enforceable lien on all real, personal, and business property in the City of

Forest Hill. The amounts of property taxes that the City expects to collect are based on the certified roll

calculated by the Tarrant Appraisal District, on behalf of the City. The September 1, 2018 certified net

taxable value of $513,513,216 is a 15.94% increase from the September 1, 2017 net taxable value of

$442,923,329. The tax year begins January 1 and fiscal year end is September 30, 2018.

46