Page 57 - Microsoft Word - Budget FY 19

P. 57

CITY OF FOREST HILL

SALES TAX

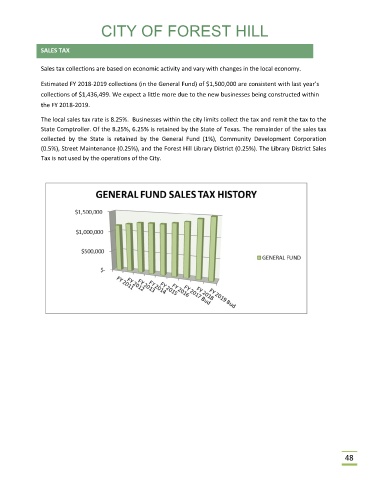

Sales tax collections are based on economic activity and vary with changes in the local economy.

Estimated FY 2018‐2019 collections (in the General Fund) of $1,500,000 are consistent with last year’s

collections of $1,436,499. We expect a little more due to the new businesses being constructed within

the FY 2018‐2019.

The local sales tax rate is 8.25%. Businesses within the city limits collect the tax and remit the tax to the

State Comptroller. Of the 8.25%, 6.25% is retained by the State of Texas. The remainder of the sales tax

collected by the State is retained by the General Fund (1%), Community Development Corporation

(0.5%), Street Maintenance (0.25%), and the Forest Hill Library District (0.25%). The Library District Sales

Tax is not used by the operations of the City.

48