Page 51 - Microsoft Word - Budget FY 19

P. 51

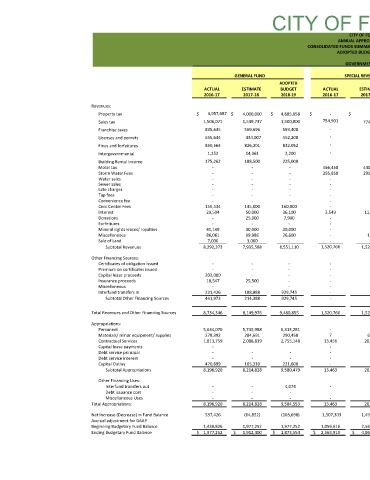

CITY OF FOREST HILL CITY OF FOREST HILL ANNUAL APPROPRIATED FUNDS CONSOLIDATED FUNDS SUMMARY (MODIFIED ACCRUAL BASIS) ADIOPTED BUDGET FY 2018‐2019 GOVERNMENTAL FUNDS CAPITAL PROJECTS FUND DEBT SERVICE FUND SPECIAL REVENUE FUNDS ADOPTED ADOPTED ADOPTED BUDGET ESTIMATE ACTUAL BUDGET ESTIMATE ACTUAL BUDGET ESTIMATE 2017‐18 2016‐17 2015‐16 2017‐18 2016‐17 2015‐16 2018‐19 2017‐18

ACTUAL 2016‐17 ‐ 754,901 ‐ ‐ ‐ ‐ 466,458 295,858 ‐ ‐ ‐ ‐ ‐ ‐ 3,549 ‐ ‐ ‐ ‐ ‐ 1,520,766 ‐ ‐ ‐ ‐ ‐ ‐ ‐ 1,520,766 ‐ 7 13,456 ‐ ‐ ‐ ‐ 13,463 ‐ - 13,463 1,507,303 1,056,616 2,563,919

$

$

ADOPTED BUDGET 2018‐19 4,685,658 1,500,000 593,400 452,200 832,052 2,200 225,000 ‐ ‐ ‐ ‐ ‐ ‐ ‐ 160,000 36,100 7,900 ‐ 30,000 26,600 ‐ 8,551,110 ‐ ‐ ‐ ‐ ‐ 929,745 929,745 9,480,855 6,313,281 290,450 2,755,148 ‐ ‐ 221,600 9,580,479 4,074 - - 9,584,553 (103,698) 1,977,252 1,873,554

$

$

GENERAL FUND ESTIMATE 2017‐18 4,000,000 1,549,737 569,696 434,007 826,301 14,361 188,500 ‐ ‐ ‐ ‐ ‐ ‐ ‐ 145,000 50,000 25,000 ‐ 30,000 99,986 3,000 7,935,588 ‐ ‐ ‐ 25,500 ‐ 188,888 214,388 8,149,976 5,735,988 284,691 2,088,839 ‐ ‐ 105,310 8,214,828 ‐ - - 8,214,828 (64,852) 1,977,252 1,912,400

$ $

ACTUAL 2016‐17 3,957,687 1,506,071 835,645 655,644 850,564 1,252 175,262 ‐ ‐ ‐ ‐ ‐ ‐ ‐ 156,534 20,504 ‐ ‐ 41,149 86,061 7,000 8,292,373 ‐ ‐ 202,000 18,547 ‐ 221,426 441,973 8,734,346 5,634,070 278,392 1,813,759 ‐ ‐ ‐ 470,699 8,196,920 ‐ - ‐ 8,196,920 537,426 1,439,826 1,977,252

$ $

Revenues: Property tax Sales tax Franchise taxes Licenses and permits Fines and forfeitures Intergovernmental Building Rental Income Motel tax Storm Water Fees Water sales Sewer sales Late charges Tap fees Convenience fee Civic Center Fees Interest Donations Forfeitures Mineral rights leases/ royalties Miscellaneous Sale of Land Subtotal Revenues Other Financing Sources: Certificates of obligation issued Premium on certificates issued Capital lease proceeds Insurance proceeds Miscellaneous Interfund transfers in Subtotal Other Fin