Page 281 - FY 19 Budget Forecast 91218.xlsx

P. 281

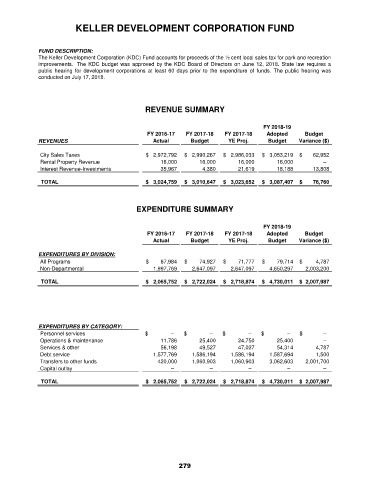

KELLER DEVELOPMENT CORPORATION FUND

FUND DESCRIPTION:

The Keller Development Corporation (KDC) Fund accounts for proceeds of the ½ cent local sales tax for park and recreation

improvements. The KDC budget was approved by the KDC Board of Directors on June 12, 2018. State law requires a

public hearing for development corporations at least 60 days prior to the expenditure of funds. The public hearing was

conducted on July 17, 2018.

REVENUE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

City Sales Taxes $ 2,972,792 $ 2,990,267 $ 2,986,033 $ 3,053,219 $ 62,952

Rental Property Revenue 16,000 16,000 16,000 16,000 –

Interest Revenue-Investments 35,967 4,380 21,619 18,188 13,808

TOTAL $ 3,024,759 $ 3,010,647 $ 3,023,652 $ 3,087,407 $ 76,760

EXPENDITURE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

Actual Budget YE Proj. Budget Variance ($)

EXPENDITURES BY DIVISION:

All Programs $ 67,984 $ 74,927 $ 71,777 $ 79,714 $ 4,787

Non-Departmental 1,997,769 2,647,097 2,647,097 4,650,297 2,003,200

TOTAL $ 2,065,752 $ 2,722,024 $ 2,718,874 $ 4,730,011 $ 2,007,987

EXPENDITURES BY CATEGORY:

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance 11,786 25,400 24,750 25,400 –

Services & other 56,198 49,527 47,027 54,314 4,787

Debt service 1,577,769 1,586,194 1,586,194 1,587,694 1,500

Transfers to other funds 420,000 1,060,903 1,060,903 3,062,603 2,001,700

Capital outlay – – – – –

TOTAL $ 2,065,752 $ 2,722,024 $ 2,718,874 $ 4,730,011 $ 2,007,987

279