Page 265 - FY 19 Budget Forecast 91218.xlsx

P. 265

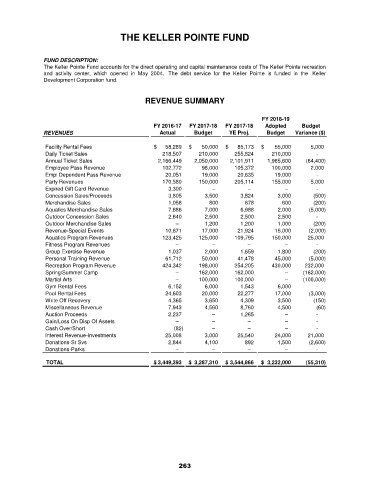

THE KELLER POINTE FUND

FUND DESCRIPTION:

The Keller Pointe Fund accounts for the direct operating and capital maintenance costs of The Keller Pointe recreation

and activity center, which opened in May 2004. The debt service for the Keller Pointe is funded in the Keller

Development Corporation fund.

REVENUE SUMMARY

FY 2018-19

FY 2016-17 FY 2017-18 FY 2017-18 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Facility Rental Fees $ 58,289 $ 50,000 $ 85,173 $ 55,000 5,000

Daily Ticket Sales 218,507 210,000 255,824 210,000 -

Annual Ticket Sales 2,166,449 2,050,000 2,101,911 1,985,600 (64,400)

Employee Pass Revenue 102,772 98,000 105,372 100,000 2,000

Empl Dependent Pass Revenue 20,051 19,000 20,635 19,000 -

Party Revenues 170,580 150,000 205,114 155,000 5,000

Expired Gift Card Revenue 3,300 – – – -

Concession Sales/Proceeds 3,805 3,500 3,824 3,000 (500)

Merchandise Sales 1,058 800 678 600 (200)

Aquatics Merchandise Sales 7,686 7,000 6,988 2,000 (5,000)

Outdoor Concession Sales 2,640 2,500 2,500 2,500 -

Outdoor Merchandise Sales – 1,200 1,200 1,000 (200)

Revenue-Special Events 10,671 17,000 21,924 15,000 (2,000)

Aquatics Program Revenues 123,425 125,000 109,795 150,000 25,000

Fitness Program Revenues – – – – -

Group Exercise Revenue 1,037 2,000 1,659 1,800 (200)

Personal Training Revenue 61,712 50,000 41,478 45,000 (5,000)

Recreation Program Revenue 424,342 198,000 254,205 430,000 232,000

Spring/Summer Camp – 162,000 162,000 – (162,000)

Martial Arts – 100,000 100,000 – (100,000)

Gym Rental Fees 6,152 6,000 1,543 6,000 -

Pool Rental Fees 24,603 20,000 22,277 17,000 (3,000)

Write Off Recovery 4,365 3,650 4,309 3,500 (150)

Miscellaneous Revenue 7,943 4,560 8,760 4,500 (60)

Auction Proceeds 2,237 – 1,265 – -

Gain/Loss On Disp Of Assets – – – – -

Cash Over/Short (82) – – – -

Interest Revenue-Investments 25,008 3,000 25,540 24,000 21,000

Donations-Sr Svs 2,844 4,100 892 1,500 (2,600)

Donations-Parks – – – – -

TOTAL $ 3,449,393 $ 3,287,310 $ 3,544,866 $ 3,232,000 (55,310)

263