Page 9 - CityofNorthRichlandHillsFY26AdoptedOperatingBudget

P. 9

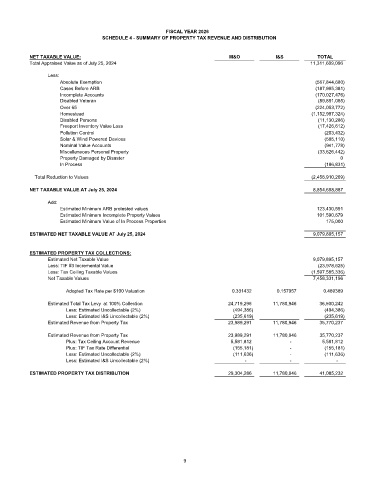

FISCAL YEAR 2026

SCHEDULE 4 - SUMMARY OF PROPERTY TAX REVENUE AND DISTRIBUTION

NET TAXABLE VALUE: M&O I&S TOTAL

Total Appraised Value as of July 25, 2024 11,311,609,096

Less:

Absolute Exemption (567,844,680)

Cases Before ARB (187,995,381)

Incomplete Accounts (170,027,476)

Disabled Veteran (89,891,085)

Over 65 (224,053,772)

Homestead (1,152,997,324)

Disabled Persons (11,130,286)

Freeport Inventory Value Loss (17,426,612)

Pollution Control (203,432)

Solar & Wind Powered Devices (585,110)

Nominal Value Accounts (941,778)

Miscellaneous Personal Property (33,626,442)

Property Damaged by Disaster 0

In Process (186,831)

Total Reduction to Values (2,456,910,209)

NET TAXABLE VALUE AT July 25, 2024 8,854,698,887

Add:

Estimated Minimum ARB protested values 123,430,591

Estimated Minimum Incomplete Property Values 101,590,679

Estimated Minimum Value of In Process Properties 175,000

ESTIMATED NET TAXABLE VALUE AT July 25, 2024 9,079,895,157

ESTIMATED PROPERTY TAX COLLECTIONS:

Estimated Net Taxable Value 9,079,895,157

Less: TIF #3 Incremental Value (23,978,625)

Less: Tax Ceiling Taxable Values (1,597,585,336)

Net Taxable Values 7,458,331,196

Adopted Tax Rate per $100 Valuation 0.331432 0.157957 0.489389

Estimated Total Tax Levy at 100% Collection 24,719,296 11,780,946 36,500,242

Less: Estimated Uncollectable (2%) (494,386) (494,386)

Less: Estimated I&S Uncollectable (2%) (235,619) (235,619)

Estimated Revenue from Property Tax 23,989,291 11,780,946 35,770,237

Estimated Revenue from Property Tax 23,989,291 11,780,946 35,770,237

Plus: Tax Ceiling Account Revenue 5,581,812 - 5,581,812

Plus: TIF Tax Rate Differential (155,181) - (155,181)

Less: Estimated Uncollectable (2%) (111,636) - (111,636)

Less: Estimated I&S Uncollectable (2%) - - -

ESTIMATED PROPERTY TAX DISTRIBUTION 29,304,286 11,780,946 41,085,232

9