Page 10 - CityofNorthRichlandHillsFY26AdoptedOperatingBudget

P. 10

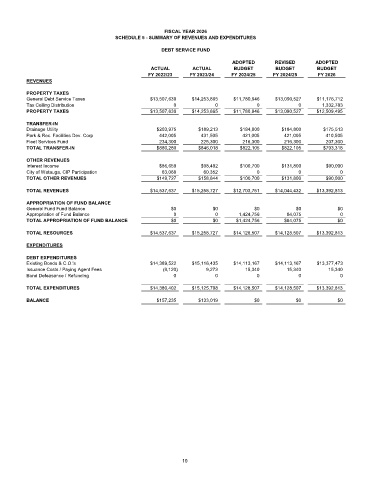

FISCAL YEAR 2026

SCHEDULE 5 - SUMMARY OF REVENUES AND EXPENDITURES

DEBT SERVICE FUND

ADOPTED REVISED ADOPTED

ACTUAL ACTUAL BUDGET BUDGET BUDGET

FY 2022/23 FY 2023/24 FY 2024/25 FY 2024/25 FY 2026

REVENUES

PROPERTY TAXES

General Debt Service Taxes $13,507,630 $14,253,865 $11,780,946 $13,090,527 $11,176,712

Tax Ceiling Distribution 0 0 0 0 1,332,783

PROPERTY TAXES $13,507,630 $14,253,865 $11,780,946 $13,090,527 $12,509,495

TRANSFER-IN

Drainage Utility $203,975 $189,213 $184,800 $184,800 $175,513

Park & Rec. Facilities Dev. Corp 442,005 431,505 421,005 421,005 410,505

Fleet Services Fund 234,300 225,300 216,300 216,300 207,300

TOTAL TRANSFER-IN $880,280 $846,018 $822,105 $822,105 $793,318

OTHER REVENUES

Interest Income $86,659 $98,492 $100,700 $131,800 $90,000

City of Watauga, CIP Participation 63,068 60,352 0 0 0

TOTAL OTHER REVENUES $149,727 $158,844 $100,700 $131,800 $90,000

TOTAL REVENUES $14,537,637 $15,258,727 $12,703,751 $14,044,432 $13,392,813

APPROPRIATION OF FUND BALANCE

General Fund Fund Balance $0 $0 $0 $0 $0

Appropriation of Fund Balance 0 0 1,424,756 84,075 0

TOTAL APPROPRIATION OF FUND BALANCE $0 $0 $1,424,756 $84,075 $0

TOTAL RESOURCES $14,537,637 $15,258,727 $14,128,507 $14,128,507 $13,392,813

EXPENDITURES

DEBT EXPENDITURES

Existing Bonds & C.O.'s $14,389,522 $15,116,435 $14,113,167 $14,113,167 $13,377,473

Issuance Costs / Paying Agent Fees (9,120) 9,273 15,340 15,340 15,340

Bond Defeasance / Refunding 0 0 0 0 0

TOTAL EXPENDITURES $14,380,402 $15,125,708 $14,128,507 $14,128,507 $13,392,813

BALANCE $157,235 $133,019 $0 $0 $0

10