Page 117 - CityofKennedaleFY26AdoptedBudget

P. 117

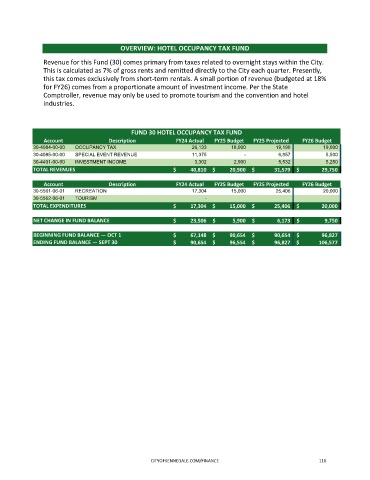

OVERVIEW: HOTEL OCCUPANCY TAX FUND

Revenue for this Fund (30) comes primary from taxes related to overnight stays within the City.

This is calculated as 7% of gross rents and remitted directly to the City each quarter. Presently,

this tax comes exclusively from short-term rentals. A small portion of revenue (budgeted at 18%

for FY26) comes from a proportionate amount of investment income. Per the State

Comptroller, revenue may only be used to promote tourism and the convention and hotel

industries.

FUND 30 HOTEL OCCUPANCY TAX FUND

Account Description FY24 Actual FY25 Budget FY25 Projected FY26 Budget

30-4084-00-00 OCCUPANCY TAX 26,133 18,000 19,190 19,000

30-4085-00-00 SPECIAL EVENT REVENUE 11,375 - 6,857 5,500

30-4401-00-00 INVESTMENT INCOME 3,302 2,900 5,532 5,250

TOTAL REVENUES $ 40,810 $ 20,900 $ 31,579 $ 29,750

Account Description FY24 Actual FY25 Budget FY25 Projected FY26 Budget

30-5561-06-01 RECREATION 17,304 15,000 25,406 20,000

30-5562-06-01 TOURISM -

TOTAL EXPENDITURES $ 17,304 $ 15,000 $ 25,406 $ 20,000

NET CHANGE IN FUND BALANCE $ 23,506 $ 5,900 $ 6,173 $ 9,750

BEGINNING FUND BALANCE — OCT 1 $ 67,148 $ 90,654 $ 90,654 $ 96,827

ENDING FUND BALANCE — SEPT 30 $ 90,654 $ 96,554 $ 96,827 $ 106,577

CITYOFKENNEDALE.COM/FINANCE 116