Page 281 - BudgetBookCover_FY26_Adopted.pdf

P. 281

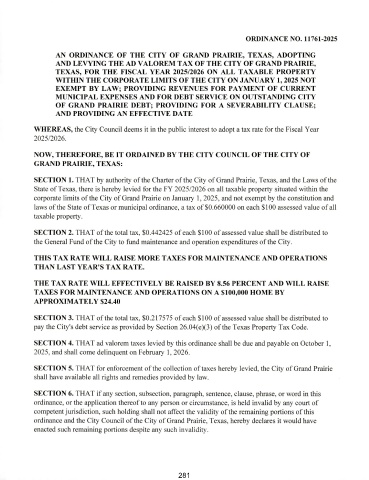

ORDINANCE NO. 11761- 2025

AN ORDINANCE OF THE CITY OF GRAND PRAIRIE, TEXAS, ADOPTING

AND LEVYING THE AD VALOREM TAX OF THE CITY OF GRAND PRAIRIE,

TEXAS, FOR THE FISCAL YEAR 2025/ 2026 ON ALL TAXABLE PROPERTY

WITHIN THE CORPORATE LIMITS OF THE CITY ON JANUARY 1, 2025 NOT

EXEMPT BY LAW; PROVIDING REVENUES FOR PAYMENT OF CURRENT

MUNICIPAL EXPENSES AND FOR DEBT SERVICE ON OUTSTANDING CITY

OF GRAND PRAIRIE DEBT; PROVIDING FOR A SEVERABILITY CLAUSE;

AND PROVIDING AN EFFECTIVE DATE

WHEREAS, the City Council deems it in the public interest to adopt a tax rate for the Fiscal Year

2025/ 2026.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF

GRAND PRAIRIE, TEXAS:

SECTION 1. THAT by authority of the Charter of the City of Grand Prairie, Texas, and the Laws of the

State of Texas, there is hereby levied for the FY 2025/2026 on all taxable property situated within the

corporate limits of the City of Grand Prairie on January 1, 2025, and not exempt by the constitution and

laws of the State of Texas or municipal ordinance, a tax of$ 0. 660000 on each $ 100 assessed value of all

taxable property.

SECTION 2. THAT of the total tax, $ 0. 442425 of each$ 100 of assessed value shall be distributed to

the General Fund of the City to fund maintenance and operation expenditures of the City.

THIS TAX RATE WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS

THAN LAST YEAR' S TAX RATE.

THE TAX RATE WILL EFFECTIVELY BE RAISED BY 8. 56 PERCENT AND WILL RAISE

TAXES FOR MAINTENANCE AND OPERATIONS ON A $100, 000 HOME BY

APPROXIMATELY$ 24. 40

SECTION 3. THAT of the total tax, $ 0. 217575 of each$ 100 of assessed value shall be distributed to

pay the City's debt service as provided by Section 26.04( e)( 3) of the Texas Property Tax Code.

SECTION 4. THAT ad valorem taxes levied by this ordinance shall be due and payable on October 1,

2025, and shall come delinquent on February 1, 2026.

SECTION 5. THAT for enforcement of the collection of taxes hereby levied, the City of Grand Prairie

shall have available all rights and remedies provided by law.

SECTION 6. THAT if any section, subsection, paragraph, sentence, clause, phrase, or word in this

ordinance, or the application thereof to any person or circumstance, is held invalid by any court of

competent jurisdiction, such holding shall not affect the validity ofthe remaining portions of this

ordinance and the City Council of the City of Grand Prairie, Texas, hereby declares it would have

enacted such despite such

remaining portions any invalidity.

281