Page 280 - BudgetBookCover_FY26_Adopted.pdf

P. 280

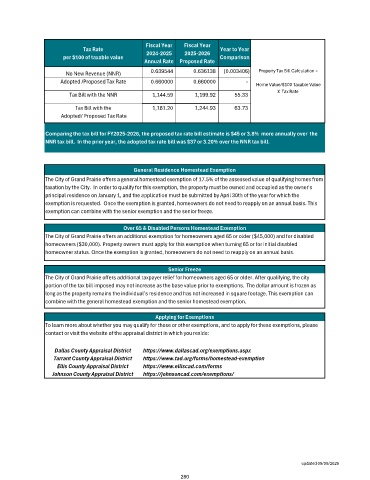

Fiscal Year Fiscal Year

Tax Rate Year to Year

per $100 of taxable value 2024-2025 2025-2026 Comparison

Annual Rate Proposed Rate

No New Revenue (NNR) 0.639544 0.636138 (0.003406) Property Tax Bill Calculation =

Adopted /Proposed Tax Rate 0.660000 0.660000 - Home Value/$100 Taxable Value

X Tax Rate

Tax Bill with the NNR 1,144.59 1,199.92 55.33

Tax Bill with the 1,181.20 1,244.93 63.73

Adopted/ Proposed Tax Rate

Comparing the tax bill for FY2025-2026, the proposed tax rate bill estimate is $45 or 3.8% more annually over the

NNR tax bill. In the prior year, the adopted tax rate bill was $37 or 3.20% over the NNR tax bill.

General Residence Homestead Exemption

The City of Grand Prairie offers a general homestead exemption of 17.5% of the assessed value of qualifying homes from

taxation by the City. In order to qualify for this exemption, the property must be owned and occupied as the owner's

principal residence on January 1, and the application must be submitted by April 30th of the year for which the

exemption is requested. Once the exemption is granted, homeowners do not need to reapply on an annual basis. This

exemption can combine with the senior exemption and the senior freeze.

Over 65 & Disabled Persons Homestead Exemption

The City of Grand Prairie offers an additional exemption for homeowners aged 65 or older ($45,000) and for disabled

homeowners ($30,000). Property owners must apply for this exemption when turning 65 or for initial disabled

homeowner status. Once the exemption is granted, homeowners do not need to reapply on an annual basis.

Senior Freeze

The City of Grand Prairie offers additional taxpayer relief for homeowners aged 65 or older. After qualifying, the city

portion of the tax bill imposed may not increase as the base value prior to exemptions. The dollar amount is frozen as

long as the property remains the individual’s residence and has not increased in square footage. This exemption can

combine with the general homestead exemption and the senior homestead exemption.

Applying for Exemptions

To learn more about whether you may qualify for these or other exemptions, and to apply for these exemptions, please

contact or visit the website of the appraisal district in which you reside:

Dallas County Appraisal District https://www.dallascad.org/exemptions.aspx

Tarrant County Appraisal District https://www.tad.org/forms/homestead-exemption

Ellis County Appraisal District https://www.elliscad.com/forms

Johnson County Appraisal District https://johnsoncad.com/exemptions/

updated 09/09/2025

280