Page 279 - BudgetBookCover_FY26_Adopted.pdf

P. 279

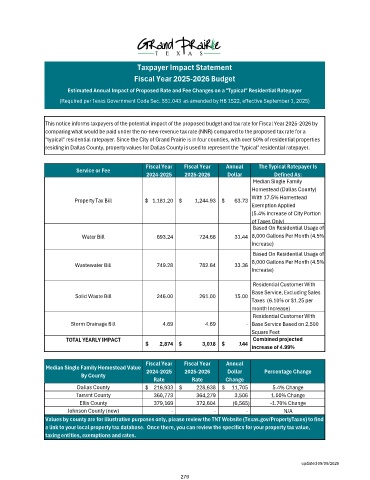

Taxpayer Impact Statement

Fiscal Year 2025-2026 Budget

Estimated Annual Impact of Proposed Rate and Fee Changes on a "Typical" Residential Ratepayer

(Required per Texas Government Code Sec. 551.043 as amended by HB 1522, effective September 1, 2025)

This notice informs taxpayers of the potential impact of the proposed budget and tax rate for Fiscal Year 2025-2026 by

comparing what would be paid under the no-new-revenue tax rate (NNR) compared to the proposed tax rate for a

"typical" residential ratepayer. Since the City of Grand Prairie is in four counties, with over 50% of residential properties

residing in Dallas County, property values for Dallas County is used to represent the "typical" residential ratepayer.

Fiscal Year Fiscal Year Annual The Typical Ratepayer Is

Service or Fee

2024-2025 2025-2026 Dollar Defined As:

Median Single Family

Homestead (Dallas County)

With 17.5% Homestead

Property Tax Bill $ 1,181.20 $ 1,244.93 $ 63.73

Exemption Applied

(5.4% Increase of City Portion

of Taxes Only)

Based On Residential Usage of

Water Bill 693.24 724.68 31.44 8,000 Gallons Per Month (4.5%

Increase)

Based On Residential Usage of

Wastewater Bill 749.28 782.64 33.36 8,000 Gallons Per Month (4.5%

Increase)

Residential Customer With

Base Service, Excluding Sales

Solid Waste Bill 246.00 261.00 15.00

Taxes (6.10% or $1.25 per

month Increase)

Residential Customer With

Storm Drainage Bill 4.69 4.69 - Base Service Based on 2,500

Square Feet

TOTAL YEARLY IMPACT Combined projected

$ 2,874 $ 3,018 $ 144

increase of 4.99%

Fiscal Year Fiscal Year Annual

Median Single Family Homestead Value 2024-2025 2025-2026 Dollar Percentage Change

By County

Rate Rate Change

Dallas County $ 216,933 $ 228,638 $ 11,705 5.4% Change

Tarrant County 360,773 364,279 3,506 1.00% Change

Ellis County 379,169 372,604 (6,565) -1.70% Change

Johnson County (new) - - - N/A

Values by county are for illustrative purposes only, please review the TNT Website (Texas.gov/PropertyTaxes) to find

a link to your local property tax database. Once there, you can review the specifics for your property tax value,

taxing entities, exemptions and rates.

updated 09/09/2025

279