Page 38 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 38

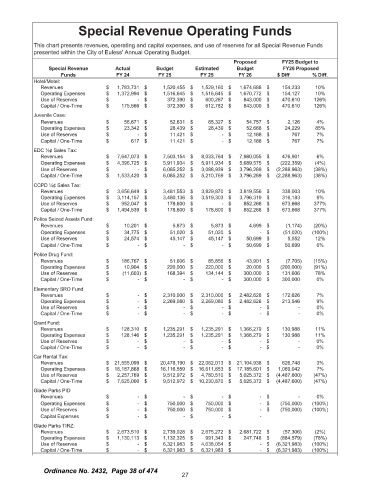

Special Revenue Operating Funds

This chart presents revenues, operating and capital expenses, and use of reserves for all Special Revenue Funds

presented within the City of Euless' Annual Operating Budget.

Proposed FY25 Budget to

Special Revenue Actual Budget Estimated Budget FY26 Proposed

Funds FY 24 FY 25 FY 25 FY 26 $ Diff % Diff.

Hotel/ Motel:

Revenues $ 1, 783, 731 $ 1, 520, 455 $ 1, 529, 160 $ 1, 674, 688 $ 154, 233 10%

Operating Expenses $ 1, 372, 994 $ 1, 516, 645 $ 1, 516, 645 $ 1, 670, 772 $ 154, 127 10%

Use of Reserves $ - $ 372, 390 $ 600, 267 $ 843, 000 $ 470, 610 126%

Capital / One -Time $ 175, 566 $ 372, 390 $ 612, 782 $ 843, 000 $ 470, 610 126%

Juvenile Case:

Revenues $ 56, 671 $ 52, 631 $ 65, 327 $ 54, 757 $ 2, 126 4%

Operating Expenses $ 23, 342 $ 28, 439 $ 28, 439 $ 52, 668 $ 24, 229 85%

Use of Reserves $ - $ 11, 421 $ - $ 12, 188 $ 767 7%

Capital / One - Time $ 617 $ 11, 421 $ - $ 12, 188 $ 767 7%

EDC'/ 4 Sales Tax:

Revenues $ 7, 647, 073 $ 7, 503, 154 $ 8, 033, 764 $ 7, 980, 055 $ 476, 901 6%

Operating Expenses $ 4, 396, 725 $ 5, 911, 934 $ 5, 911, 934 $ 5, 689, 575 $ ( 222, 359) ( 4%)

Use of Reserves $ - $ 6, 085, 252 $ 3, 088, 939 $ 3, 796, 289 $ ( 2, 288, 963) ( 38%)

Capital / One -Time $ 1, 533, 420 $ 6, 085, 252 $ 5, 210, 769 $ 3, 796, 289 $ ( 2, 288, 963) ( 38%)

CCPD'/¢ Sales Tax:

Revenues $ 3, 656, 649 $ 3, 481, 553 $ 3, 829, 870 $ 3, 819, 556 $ 338, 003 10%

Operating Expenses $ 3, 114, 157 $ 3, 480, 136 $ 3, 519, 303 $ 3, 796, 319 $ 316, 183 9%

Use of Reserves $ 952, 047 $ 178,600 $ - $ 852, 268 $ 673, 668 377%

Capital / One -Time $ 1, 494, 539 $ 178,600 $ 178, 600 $ 852, 268 $ 673, 668 377%

Police Seized Assets Fund:

Revenues $ 10, 201 $ 5, 873 $ 5, 873 $ 4, 699 $ ( 1, 174) ( 20%)

Operating Expenses $ 34, 775 $ 51, 020 $ 51, 020 $ - $ ( 51, 020) ( 100%)

Use of Reserves $ 24, 574 $ 45, 147 $ 45, 147 $ 50, 699 $ 5, 552 12%

Capital / One - Time $ - $ - $ - $ 50, 699 $ 50, 699 0%

Police Drug Fund:

Revenues $ 186, 767 $ 51, 606 $ 85, 856 $ 43, 901 $ ( 7, 705) ( 15%)

Operating Expenses $ 10, 904 $ 220, 000 $ 220, 000 $ 20, 000 $ ( 200, 000) ( 91%)

Use of Reserves $ ( 11, 603) $ 168, 394 $ 134, 144 $ 300, 000 $ 131, 606 78%

Capital / One - Time $ - $ - $ - $ 300, 000 $ 300, 000 0%

Elementary SRO Fund

Revenues $ - $ 2, 310, 000 $ 2, 310, 000 $ 2, 482, 626 $ 172, 626 7%

Operating Expenses $ - $ 2, 269, 080 $ 2, 269, 080 $ 2, 482, 626 $ 213, 546 9%

Use of Reserves $ - $ - $ - $ - $ - 0%

Capital / One - Time $ - $ - $ - $ - $ - 0%

Grant Fund:

Revenues $ 128, 310 $ 1, 235, 291 $ 1, 235, 291 $ 1, 366, 279 $ 130, 988 11%

Operating Expenses $ 128, 146 $ 1, 235, 291 $ 1, 235, 291 $ 1, 366, 279 $ 130, 988 11%

Use of Reserves $ - $ - $ - $ - $ - 0%

Capital / One -Time $ - $ - $ - $ - $ - 0%

Car Rental Tax:

Revenues $ 21, 555, 099 $ 20, 478, 190 $ 22, 062, 013 $ 21, 104, 938 $ 626, 748 3%

Operating Expenses $ 16, 187, 868 $ 16, 116, 559 $ 16, 611, 653 $ 17, 185, 601 $ 1, 069, 042 7%

Use of Reserves $ 2, 257, 769 $ 9, 512, 972 $ 4, 780, 510 $ 5, 025, 372 $ ( 4, 487, 600) ( 47%)

Capital / One - Time $ 7, 625, 000 $ 9, 512, 972 $ 10, 230, 870 $ 5, 025, 372 $ ( 4, 487, 600) ( 47%)

Glade Parks PID

Revenues $ - $ - $ - $ - $ - 0%

Operating Expenses $ - $ 750, 000 $ 750, 000 $ - $ ( 750, 000) ( 100%)

Use of Reserves $ - $ 750, 000 $ 750, 000 $ - $ ( 750, 000) ( 100%)

Capital Expenses $ - $ - $ - $ -

Glade Parks TIRZ:

Revenues $ 2, 673, 510 $ 2, 739, 028 $ 2, 675, 272 $ 2, 681, 722 $ ( 57, 306) ( 2%)

Operating Expenses $ 1, 130, 113 $ 1, 132,325 $ 991, 343 $ 247, 746 $ ( 884, 579) ( 78%)

Use of Reserves $ - $ 6, 321, 983 $ 4, 638, 054 $ - $ ( 6, 321, 983) ( 100%)

Capital / One -Time $ - $ 6, 321, 983 $ 6, 321, 983 $ - $ ( 6, 321, 983) ( 100%)

Ordinance No. 2432, Page 38 of 474

27