Page 112 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 112

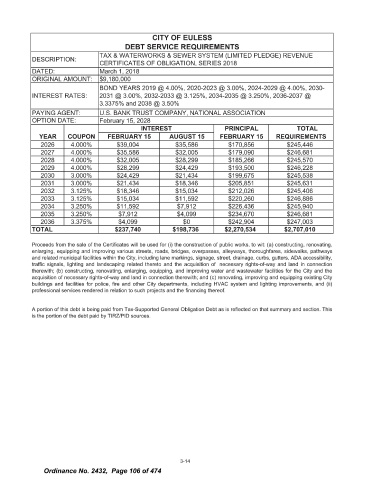

CITY OF EULESS

DEBT SERVICE REQUIREMENTS

TAX & WATERWORKS & SEWER SYSTEM ( LIMITED PLEDGE) REVENUE

DESCRIPTION:

CERTIFICATES OF OBLIGATION, SERIES 2018

DATED: March 1, 2018

ORIGINAL AMOUNT: $ 9, 180, 000

BOND YEARS 2019 @ 4. 00%, 2020- 2023 @ 3. 00%, 2024- 2029 @ 4. 00%, 2030-

INTEREST RATES: 2031 @ 3. 00%, 2032- 2033 @ 3. 125%, 2034- 2035 @ 3. 250%, 2036- 2037 @

3. 3375% and 2038 @ 3. 50%

PAYING AGENT: U. S. BANK TRUST COMPANY, NATIONAL ASSOCIATION

OPTION DATE: February 15, 2028

INTEREST PRINCIPAL TOTAL

YEAR COUPON FEBRUARY 15 AUGUST 15 FEBRUARY 15 REQUIREMENTS

2026 4. 000% $ 39, 004 $ 35, 586 $ 170, 856 $ 245, 446

2027 4. 000% $ 35, 586 $ 32, 005 $ 179, 090 $ 246, 681

2028 4. 000% $ 32, 005 $ 28, 299 $ 185, 266 $ 245, 570

2029 4. 000% $ 28, 299 $ 24, 429 $ 193, 500 $ 246, 228

2030 3. 000% $ 24, 429 $ 21, 434 $ 199, 675 $ 245, 538

2031 3. 000% $ 21, 434 $ 18, 346 $ 205, 851 $ 245, 631

2032 3. 125% $ 18, 346 $ 15, 034 $ 212, 026 $ 245, 406

2033 3. 125% $ 15, 034 $ 11, 592 $ 220, 260 $ 246, 886

2034 3. 250% $ 11, 592 $ 7, 912 $ 226, 436 $ 245, 940

2035 3. 250% $ 7, 912 $ 4, 099 $ 234, 670 $ 246, 681

2036 3. 375% $ 4, 099 $ 0 $ 242, 904 $ 247, 003

TOTAL $ 237, 740 $ 198, 736 $ 2, 270, 534 $ 2, 707, 010

Proceeds from the sale of the Certificates will be used for ( i) the construction of public works, to wit: ( a) constructing, renovating,

enlarging, equipping and improving various streets, roads, bridges, overpasses, alleyways, thoroughfares, sidewalks, pathways

and related municipal facilities within the City, including lane markings, signage, street, drainage, curbs, gutters, ADA accessibility,

traffic signals, lighting and landscaping related thereto and the acquisition of necessary rights - of -way and land in connection

therewith; ( b) constructing, renovating, enlarging, equipping, and improving water and wastewater facilities for the City and the

acquisition of necessary rights - of -way and land in connection therewith; and ( c) renovating, improving and equipping existing City

buildings and facilities for police, fire and other City departments, including HVAC system and lighting improvements, and ( ii)

professional services rendered in relation to such projects and the financing thereof.

A portion of this debt is being paid from Tax -Supported General Obligation Debt as is reflected on that summary and section. This

is the portion of the debt paid by TIRZ/ PID sources.

3- 14

Ordinance No. 2432, Page 106 of 474