Page 108 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 108

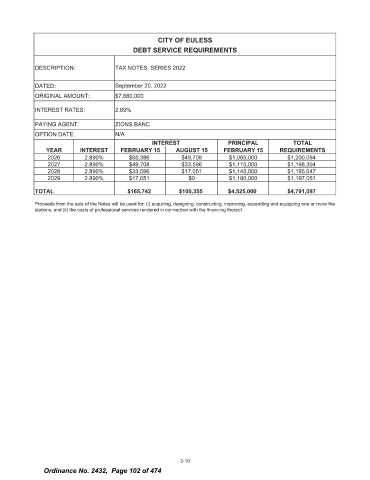

CITY OF EULESS

DEBT SERVICE REQUIREMENTS

DESCRIPTION: TAX NOTES, SERIES 2022

DATED: September 20, 2022

ORIGINAL AMOUNT: $ 7, 660, 000

INTEREST RATES: 2. 89%

PAYING AGENT: ZIONS BANC

OPTION DATE: N/ A

INTE REST PRINCIPAL TOTAL

YEAR INTEREST FEBRUARY 15 AUGUST 15 FEBRUARY 15 REQUIREMENTS

2026 2. 890% $ 65, 386 $ 49, 708 $ 1, 085, 000 $ 1, 200, 094

2027 2. 890% $ 49, 708 $ 33, 596 $ 1, 115, 000 $ 1, 198, 304

2028 2. 890% $ 33, 596 $ 17, 051 $ 1, 145, 000 $ 1, 195, 647

2029 2. 890% $ 17, 051 $ 0 $ 1, 180, 000 $ 1, 197, 051

TOTAL 165, 742 $ 100, 355 $ 4, 525, 000 $ 4, 791, 097

Proceeds from the sale of the Notes will be used for: ( i) acquiring, designing, constructing, improving, expanding and equipping one or more fire

stations, and ( ii) the costs of professional services rendered in connection with the financing thereof.

3- 10

Ordinance No. 2432, Page 102 of 474