Page 87 - CityofDalworthingtonGardensFY26AdoptedBudget

P. 87

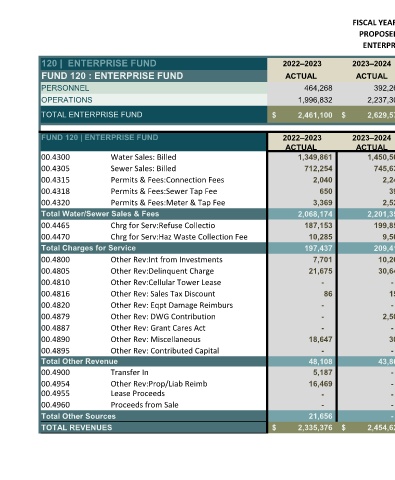

FISCAL YEAR 2025-2026

PROPOSED BUDGET

ENTERPRISE FUND

120 | ENTERPRISE FUND 2022–2023 2023–2024 2024–2025 2025–2026 2025-2026

FUND 120 : ENTERPRISE FUND ACTUAL ACTUAL APPROVED APPROVED % CHANGE

PERSONNEL 464,268 392,265 547,378 571,927 4.5%

OPERATIONS 1,996,832 2,237,305 2,048,304 2,107,436 2.9%

TOTAL ENTERPRISE FUND $ 2,461,100 $ 2,629,570 $ 2,595,682 $ 2,679,363 3.2%

FUND 120 | ENTERPRISE FUND 2022–2023 2023–2024 2024–2025 2025–2026 2025-2026

ACTUAL ACTUAL APPROVED ADOPTED % CHANGE

00.4300 Water Sales: Billed 1,349,861 1,450,565 1,583,322 1,625,872 2.7%

00.4305 Sewer Sales: Billed 712,254 745,633 768,552 789,206 2.7%

00.4315 Permits & Fees:Connection Fees 2,040 2,240 1,440 2,000 38.9%

00.4318 Permits & Fees:Sewer Tap Fee 650 390 260 400 53.8%

00.4320 Permits & Fees:Meter & Tap Fee 3,369 2,523 600 5,000 733.3%

Total Water/Sewer Sales & Fees 2,068,174 2,201,352 2,354,174 2,422,478 2.9%

00.4465 Chrg for Serv:Refuse Collectio 187,153 199,856 213,132 218,600 2.6%

00.4470 Chrg for Serv:Haz Waste Collection Fee 10,285 9,560 9,836 10,500 6.7%

Total Charges for Service 197,437 209,416 222,968 229,100 2.8%

00.4800 Other Rev:Int from Investments 7,701 10,264 8,051 13,800 71.4%

00.4805 Other Rev:Delinquent Charge 21,675 30,643 33,600 29,000 -13.7%

00.4810 Other Rev:Cellular Tower Lease - - - - 0.0%

00.4816 Other Rev: Sales Tax Discount 86 154 168 20 -88.1%

00.4820 Other Rev: Eqpt Damage Reimburs - - - - 0.0%

00.4879 Other Rev: DWG Contribution - 2,500 2,220 17 -99.2%

00.4887 Other Rev: Grant Cares Act - - - - 0.0%

00.4890 Other Rev: Miscellaneous 18,647 300 - 5,585 0.0%

00.4895 Other Rev: Contributed Capital - - - - 0.0%

Total Other Revenue 48,108 43,861 44,039 48,422 10.0%

00.4900 Transfer In 5,187 - - - 0.0%

00.4954 Other Rev:Prop/Liab Reimb 16,469 - - - 0.0%

00.4955 Lease Proceeds - - - - 0.0%

00.4960 Proceeds from Sale - - - - 0.0%

Total Other Sources 21,656 - - - 0.0%

TOTAL REVENUES $ 2,335,376 $ 2,454,629 $ 2,621,181 2,700,000 3.0%

42