Page 66 - ClearGov | Documents

P. 66

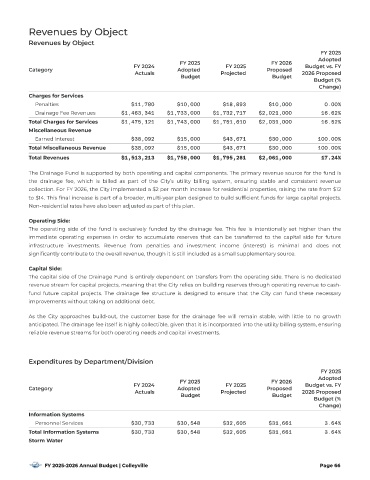

Revenues by Object

Revenues by Object

FY 2025

Adopted

FY 2025 FY 2026

FY 2024 FY 2025 Budget vs. FY

Category Adopted Proposed

Actuals Projected 2026 Proposed

Budget Budget

Budget (%

Change)

Charges for Ser vices

Penalties $11,780 $10,000 $18,893 $10,000 0.00%

Drainage Fee Revenues $1,463,341 $1,733,000 $1,732,717 $2,021,000 16.62%

Total Charges for Ser vices $1,475,121 $1,743,000 $1,751,610 $2,031,000 16.52%

Miscellaneous Revenue

Earned Interest $38,092 $15,000 $43,671 $30,000 100.00%

Total Miscellaneous Revenue $38,092 $15,000 $43,671 $30,000 100.00%

Total Revenues $1,513,213 $1,758,000 $1,795,281 $2,061,000 17.24%

The Drainage Fund is suppor ted by both operating and capital components. The primary revenue source for the fund is

the drainage fee, which is billed as par t of the City ’s utility billing system, ensuring stable and consistent revenue

collection. For FY 2026 , the City implemented a $2 per month increase for residential proper ties, raising the rate from $12

to $14 . This {nal increase is par t of a broader, multi-year plan designed to build suf{cient funds for large capital projects.

Non-residential rates have also been adjusted as par t of this plan.

Operating Side:

The operating side of the fund is exclusively funded by the drainage fee. This fee is intentionally set higher than the

immediate operating expenses in order to accumulate reser ves that can be transferred to the capital side for future

infrastructure investments. Revenue from penalties and investment income (interest) is minimal and does not

signi{cantly contribute to the overall revenue, though it is still included as a small supplementary source.

Capital Side:

The capital side of the Drainage Fund is entirely dependent on transfers from the operating side. There is no dedicated

revenue stream for capital projects, meaning that the City relies on building reser ves through operating revenue to cash-

fund future capital projects. The drainage fee structure is designed to ensure that the City can fund these necessary

improvements without taking on additional debt .

As the City approaches build- out , the customer base for the drainage fee will remain stable, with little to no growth

anticipated. The drainage fee itself is highly collectible, given that it is incorporated into the utility billing system, ensuring

reliable revenue streams for both operating needs and capital investments.

Expenditures by Depar tment/Division

FY 2025

Adopted

FY 2025 FY 2026

FY 2024 FY 2025 Budget vs. FY

Category Adopted Proposed

Actuals Projected 2026 Proposed

Budget Budget

Budget (%

Change)

Information Systems

Personnel Ser vices $30,733 $30,548 $32,605 $31,661 3.64%

Total Information Systems $30,733 $30,548 $32,605 $31,661 3.64%

Storm Water

FY 2025-2026 Annual Budget | Colleyville Page 66