Page 59 - ClearGov | Documents

P. 59

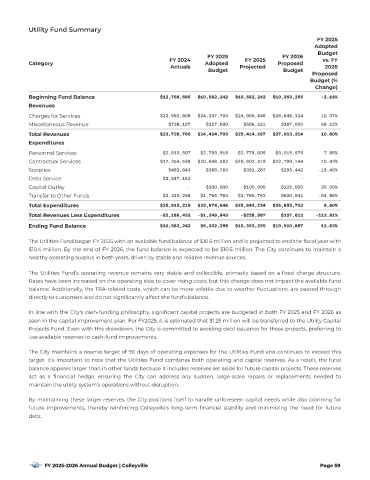

Utility Fund Summar y

FY 2025

Adopted

Budget

FY 2025 FY 2026

FY 2024 FY 2025 vs. FY

Category Adopted Proposed

Ac tuals Projec ted 2026

Budget Budget

Proposed

Budget (%

Change)

$12,768,695 $10,582,242 $10,582,242 $10,353,255 -2.16%

Beginning Fund Balance

Revenues

$22,992,609 $24,207,703 $24,905,846 $26,646,314 10.07%

Charges for Ser vices

$736,157 $217,000 $508,321 $367,000 69.12%

Miscellaneous Revenue

$23,728,766 $24,424,703 $25,414,167 $27,013,314 10.60%

Total Revenues

Expenditures

$2,610,597 $2,793,518 $2,778,605 $3,015,575 7.95%

Personnel Ser vices

$17,254,538 $20,648,582 $20,602,519 $22,799,144 10.42%

Contractual Ser vices

Supplies $492,643 $366,783 $391,267 $295,442 -19.45%

Debt Ser vice $2,247,183 - - - -

Capital Outlay - $100,000 $105,000 $125,000 25.00%

Transfer to Other Funds $3,310,258 $1,765,763 $1,765,763 $620,541 -64.86%

Total Expenditures $25,915,219 $25,674,646 $25,643,154 $26,855,702 4.60%

-$2,186,453 -$1,249,943 -$228,987 $157,612 -112.61%

Total Revenues Less Expenditures

Ending Fund Balance $10,582,242 $9,332,299 $10,353,255 $10,510,867 12.63%

The Utilities Fund began FY 2025 with an available fund balance of $10.6 million and is projected to end the {scal year with

$10.4 million. By the end of FY 2026 , the fund balance is expected to be $10.5 million. The City continues to maintain a

healthy operating surplus in both years, driven by stable and reliable revenue sources.

The Utilities Fund’s operating revenue remains very stable and collectible, primarily based on a {xed charge structure.

Rates have been increased on the operating side to cover rising costs, but this change does not impact the available fund

balance. Additionally, the TRA-related costs, which can be more volatile due to weather |uctuations, are passed through

directly to customers and do not signi{cantly affect the fund’s balance.

In line with the City's cash-funding philosophy, signi{cant capital projects are budgeted in both FY 2025 and FY 2026 as

seen in the capital improvement plan. For FY2025, it is estimated that $1. 25 million will be transferred to the Utility Capital

Projects Fund. Even with this drawdown, the City is committed to avoiding debt issuance for these projects, preferring to

use available reser ves to cash-fund improvements.

The City maintains a reser ve target of 90 days of operating expenses for the Utilities Fund and continues to exceed this

target . It’s impor tant to note that the Utilities Fund combines both operating and capital reser ves. As a result , the fund

balance appears larger than in other funds because it includes reser ves set aside for future capital projects. These reser ves

act as a {nancial hedge, ensuring the City can address any sudden, large -scale repairs or replacements needed to

maintain the utility system’s operations without disruption.

By maintaining these larger reser ves, the City positions itself to handle unforeseen capital needs while also planning for

future improvements, thereby reinforcing Colleyville’s long- term {nancial stability and minimizing the need for future

debt .

FY 2025-2026 Annual Budget | Colleyville Page 59