Page 211 - CityofArlingtonFY26AdoptedBudget

P. 211

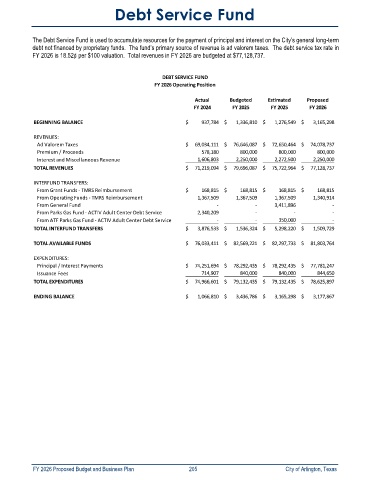

Debt Service Fund

The Debt Service Fund is used to accumulate resources for the payment of principal and interest on the City’s general long-term

debt not financed by proprietary funds. The fund’s primary source of revenue is ad valorem taxes. The debt service tax rate in

FY 2026 is 18.52¢ per $100 valuation. Total revenues in FY 2026 are budgeted at $77,128,737.

DEBT SERVICE FUND

FY 2026 Operating Position

Actual Budgeted Estimated Proposed

FY 2024 FY 2025 FY 2025 FY 2026

BEGINNING BALANCE $ 937,784 $ 1,336,810 $ 1,276,549 $ 3,165,298

REVENUES:

Ad Valorem Taxes $ 69,034,111 $ 76,646,087 $ 72,650,464 $ 74,078,737

Premium / Proceeds 578,180 800,000 800,000 800,000

Interest and Miscellaneous Revenue 1,606,803 2,250,000 2,272,500 2,250,000

TOTAL REVENUES $ 71,219,094 $ 79,696,087 $ 75,722,964 $ 77,128,737

INTERFUND TRANSFERS:

From Grant Funds - TMRS Reimbursement $ 168,815 $ 168,815 $ 168,815 $ 168,815

From Operating Funds - TMRS Reimbursement 1,367,509 1,367,509 1,367,509 1,340,914

From General Fund - - 3,411,896 -

From Parks Gas Fund - ACTIV Adult Center Debt Service 2,340,209 - - -

From ATF Parks Gas Fund - ACTIV Adult Center Debt Service - - 350,000 -

TOTAL INTERFUND TRANSFERS $ 3,876,533 $ 1,536,324 $ 5,298,220 $ 1,509,729

TOTAL AVAILABLE FUNDS $ 76,033,411 $ 82,569,221 $ 82,297,733 $ 81,803,764

EXPENDITURES:

Principal / Interest Payments $ 74,251,694 $ 78,292,435 $ 78,292,435 $ 77,781,247

Issuance Fees 714,907 840,000 840,000 844,650

TOTAL EXPENDITURES $ 74,966,601 $ 79,132,435 $ 79,132,435 $ 78,625,897

ENDING BALANCE $ 1,066,810 $ 3,436,786 $ 3,165,298 $ 3,177,867

FY 2026 Proposed Budget and Business Plan 205 City of Arlington, Texas