Page 15 - WestworthVillageFY25ApprovedBudget

P. 15

15

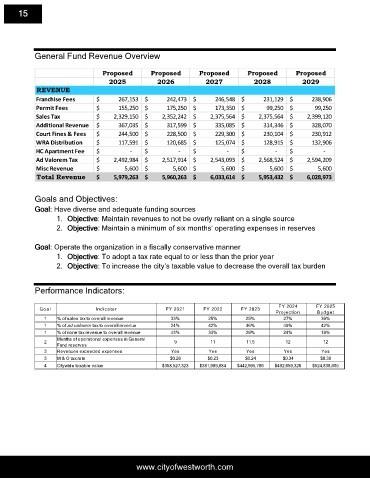

General Fund Revenue Overview

Proposed Proposed Proposed Proposed Proposed

2025 2026 2027 2028 2029

REVENUE

Franchise Fees $ 267,153 $ 242,473 $ 246,548 $ 231,129 $ 238,906

Permit Fees $ 155,250 $ 175,250 $ 173,350 $ 99,250 $ 99,250

Sales Tax $ 2,329,150 $ 2,352,242 $ 2,375,564 $ 2,375,564 $ 2,399,120

Additional Revenue $ 367,035 $ 317,599 $ 335,085 $ 314,346 $ 328,070

Court Fines & Fees $ 244,500 $ 228,500 $ 229,300 $ 230,104 $ 230,912

WRA Distribution $ 117,591 $ 120,685 $ 125,074 $ 128,915 $ 132,906

HC Apartment Fee $ - $ - $ - $ - $ -

Ad Valorem Tax $ 2,492,984 $ 2,517,914 $ 2,543,093 $ 2,568,524 $ 2,594,209

Misc Revenue $ 5,600 $ 5,600 $ 5,600 $ 5,600 $ 5,600

Total Revenue $ 5,979,263 $ 5,960,263 $ 6,033,614 $ 5,953,432 $ 6,028,973

Goals and Objectives:

Goal: Have diverse and adequate funding sources

1. Objective: Maintain revenues to not be overly reliant on a single source

2. Objective: Maintain a minimum of six months’ operating expenses in reserves

Goal: Operate the organization in a fiscally conservative manner

1. Objective: To adopt a tax rate equal to or less than the prior year

2. Objective: To increase the city’s taxable value to decrease the overall tax burden

Performance Indicators:

FY 2024 FY 2025

Goal Indicator FY 2021 FY 2022 FY 2023

Projection Budget

1 % of sales tax to overall revenue 33% 25% 25% 27% 39%

1 % of ad valorem tax to overall revenue 24% 42% 46% 49% 42%

1 % of none tax revenue to overall revenue 43% 33% 29% 24% 19%

Months of operational expenses in General

2 9 11 11.5 12 12

Fund reserves

3 Revenues exceeded expenses Yes Yes Yes Yes Yes

3 M & O tax rate $0.26 $0.23 $0.24 $0.34 $0.30

4 Citywide taxable value $358,527,323 $381,989,884 $442,995,786 $492,659,326 $524,838,685

www.cityofwestworth.com