Page 9 - TownofWestlakeFY25BudgetOrd1005

P. 9

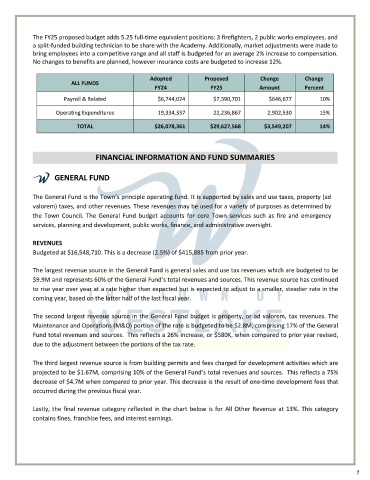

The FY25 proposed budget adds 5.25 full-time equivalent positions: 3 firefighters, 2 public works employees, and

a split-funded building technician to be share with the Academy. Additionally, market adjustments were made to

bring employees into a competitive range and all staff is budgeted for an average 2% increase to compensation.

No changes to benefits are planned, however insurance costs are budgeted to increase 12%.

Adopted Proposed Change Change

ALL FUNDS

FY24 FY25 Amount Percent

Payroll & Related $ 6,744,024 $ 7,390,701 $ 646,677 10%

Operating Expenditures 19,334,337 22,236,867 2,902,530 15%

TOTAL $ 26,078,361 $ 29,627,568 $ 3,549,207 14%

FINANCIAL INFORMATION AND FUND SUMMARIES

GENERAL FUND

The General Fund is the Town’s principle operating fund. It is supported by sales and use taxes, property ( ad

valorem) taxes, and other revenues. These revenues may be used for a variety of purposes as determined by

the Town Council. The General Fund budget accounts for core Town services such as fire and emergency

services, planning and development, public works, finance, and administrative oversight.

REVENUES

Budgeted at $16,548,710. This is a decrease ( 2.5%) of $415,885 from prior year.

The largest revenue source in the General Fund is general sales and use tax revenues which are budgeted to be

9.9M and represents 60% of the General Fund’s total revenues and sources. This revenue source has continued

to rise year over year at a rate higher than expected but is expected to adjust to a smaller, steadier rate in the

coming year, based on the latter half of the last fiscal year.

The second largest revenue source in the General Fund budget is property, or ad valorem, tax revenues. The

Maintenance and Operations ( M&O) portion of the rate is budgeted to be $2.8M, comprising 17% of the General

Fund total revenues and sources. This reflects a 26% increase, or $580K, when compared to prior year revised,

due to the adjustment between the portions of the tax rate.

The third largest revenue source is from building permits and fees charged for development activities which are

projected to be $1.67M, comprising 10% of the General Fund’s total revenues and sources. This reflects a 75%

decrease of $4.7M when compared to prior year. This decrease is the result of one-time development fees that

occurred during the previous fiscal year.

Lastly, the final revenue category reflected in the chart below is for All Other Revenue at 13%. This category

contains fines, franchise fees, and interest earnings.

7