Page 7 - TownofWestlakeFY25BudgetOrd1005

P. 7

PROPERTY TAX

The municipal property tax rate (or ad valorem rate) will maintain the current adopted rate of $0.16788 per

100 of assessed valuation. This rate is lower ( by $0.020635) than the no-new-revenue rate ( formerly the

effective tax rate”), which is the total tax rate needed to generate the same amount of property tax revenue

for the Town from the same properties between the 2024 tax year and the 2025 tax year.

This budget adheres to direction the Council gave to stabilize our ad valorem rate, monitor expenditures, and

pause major capital expenditures while the program is evaluated. These directives help ensure we plan for the

Town’s financial stability and are better prepared to meet the service delivery expectations of our community.

Our approach to both revenue estimating and expenditure requests continue to proceed in a fiscally

conservative manner without raising the rate for our property owners and still allow Westlake the ability to

exceed expectations of our residents.

The ad valorem tax is allocated between Maintenance and Operations ( M&O) in the General Fund and Interest

and Sinking ( I&S) debt service for the Town. The allocation for M&O is $0.11788 and the projected revenue

totals $2.8M. The allocation for I&S debt service is $0.05000 and the projected revenue totals $1.2M. Please

see the tax rate change below:

Tax Rate Change FY24 FY25

Adopted Proposed Variance

M&O $ 0.09117 $ 0.11788 $ 0.02671

I&S $ 0.07671 $ 0.05000 ($ 0.02671)

Total $ 0.16788 $ 0.16788 $ 0.00

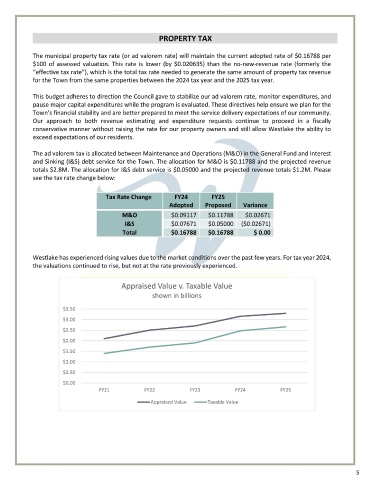

Westlake has experienced rising values due to the market conditions over the past few years. For tax year 2024,

the valuations continued to rise, but not at the rate previously experienced.

Appraised Value v. Taxable Value

shown in billions

3.50

3.00

2.50

2.00

1.50

1.00

0.50

0.00

FY21 FY22 FY23 FY24 FY25

Appraised Value Taxable Value

5