Page 118 - TownofWestlakeFY25BudgetOrd1005

P. 118

PROPERTY TAX RATE

Property tax is the fourth largest revenue source for the Town of Westlake. The rate levied is required to be

adopted in two parts:

M&O: The Maintenance & Operations rate is set to raise the funds necessary to support the general operations

of the Town and is budgeted only within the General Fund. The M&O portion is budgeted to provide $2.8M in

General Fund revenue.

I&S: The Interest & Sinking rate is the minimum rate set to provide for the Town’s debt service requirements

for the upcoming fiscal year. This rate accounts for principal and interest on bonds and other debt secured by

property tax revenue. The I&S portion is budgeted to provide $1.2M

Tax Rate Change FY2024 FY2025 Variance

Adopted Adopted

M&O $ 0.09117 $ 0.11788 $ 0.02671

I&S $ 0.07671 $ 0.05000 $( 0.02671)

Total $ 0.16788 $ 0.16788 $ 0.00

The Town of Westlake paid off a tax note during FY2024 and was able to move that portion of the I&S rate to

the M&O portion to adequately fund the General Fund obligations without passing along a rate increase to its

constituents. The overall rate remains one of the lowest within the State of Texas.

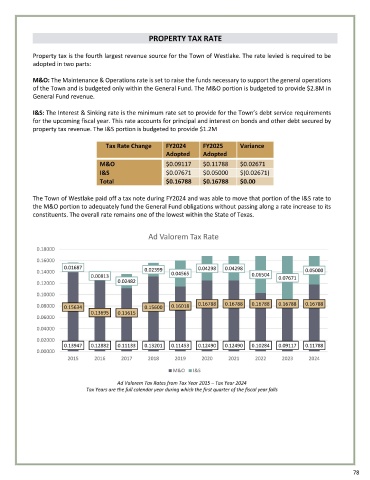

Ad Valorem Tax Rate

0.18000

0.16000

0.01687 0.04298 0.04298

0.14000 0.02399 0.04565 0.05000

0.00813 0.06504 0.07671

0.12000 0.02482

0.10000

0.08000 0.15634 0.15600 0.16018 0.16788 0.16788 0.16788 0.16788 0.16788

0.13695 0.13615

0.06000

0.04000

0.02000

0.13947 0.12882 0.11133 0.13201 0.11453 0.12490 0.12490 0.10284 0.09117 0.11788

0.00000

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

M&O I&S

Ad Valorem Tax Rates from Tax Year 2015 – Tax Year 2024

Tax Years are the full calendar year during which the first quarter of the fiscal year falls

78