Page 119 - TownofWestlakeFY25BudgetOrd1005

P. 119

VALUATION

PROPERTY VALUES

The Town of Westlake does not appraise any property. The Tarrant Appraisal District and Denton Central

Appraisal District are responsible for the appraisal values, applied exemptions and abatements, and protests

for all real property, including business personal property, within the Town limits. The Town uses the

information provided to calculate the various required tax rates and determine the rate to levy.

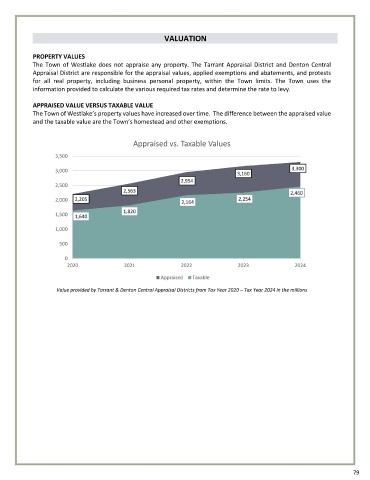

APPRAISED VALUE VERSUS TAXABLE VALUE

The Town of Westlake’ s property values have increased over time. The difference between the appraised value

and the taxable value are the Town’s homestead and other exemptions.

Appraised vs. Taxable Values

3,500

3,300

3,000

3,160

2,954

2,500

2,563 2,460

2,000 2,205 2,254

2,164

1,820

1,500 1,640

1,000

500

0

2020 2021 2022 2023 2024

Appraised Taxable

Value provided by Tarrant & Denton Central Appraisal Districts from Tax Year 2020 – Tax Year 2024 in the millions

79