Page 120 - CityofSouthlakeFY25AdoptedBudget

P. 120

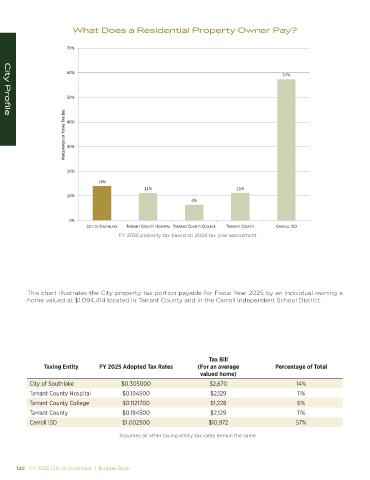

What Does a Residential Property Owner Pay?

ϳϬй

ϲϬй ϱϳй

ϱϬй

W Z Ed ' K& dKd > d y />> ϰϬй

City Profile

ϯϬй

ϮϬй

ϭϰй

ϭϭй ϭϭй

ϭϬй

ϲй

Ϭй

/dz K& ^Khd,> < d ZZ Ed KhEdz ,K^W/d > d ZZ Ed KhEdz K>> ' d ZZ Ed KhEdz ZZK>> /^

FY 2025 property tax based on 2024 tax year assessment

This chart illustrates the City property tax portion payable for Fiscal Year 2025 by an individual owning a

home valued at $1,094,414 located in Tarrant County and in the Carroll Independent School District.

Tax Bill

Taxing Entity FY 2025 Adopted Tax Rates (For an average Percentage of Total

valued home)

City of Southlake $0.305000 $2,670 14%

Tarrant County Hospital $0.194500 $2,129 11%

Tarrant County College $0.1121700 $1,228 6%

Tarrant County $0.194500 $2,129 11%

Carroll ISD $1.002500 $10,972 57%

Assumes all other taxing entity tax rates remain the same

120 FY 2025 City of Southlake | Budget Book