Page 119 - CityofSouthlakeFY25AdoptedBudget

P. 119

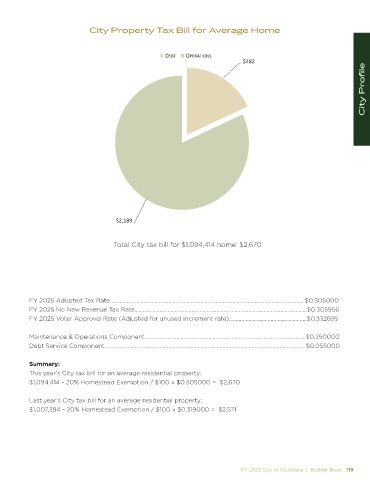

City Property Tax Bill for Average Home

d KW Z d/KE^

ΨϰϴϮ

City Profile

ΨϮ͕ϭϴϵ

Total City tax bill for $1,094,414 home: $2,670

FY 2025 Adopted Tax Rate ............................................................................................................................................$0.305000

FY 2025 No New Revenue Tax Rate............................................................................................................................$0.305956

FY 2025 Voter Approval Rate (Adjusted for unused increment rate)........................................................$0.332695

Maintenance & Operations Component....................................................................................................................$0.250000

Debt Service Component.................................................................................................................................................$0.055000

Summary:

This year’s City tax bill for an average residential property:

$1,094,414 - 20% Homestead Exemption / $100 x $0.305000 = $2,670

Last year’s City tax bill for an average residential property:

$1,007,394 - 20% Homestead Exemption / $100 x $0.319000 = $2,571

FY 2025 City of Southlake | Budget Book 119