Page 83 - CityofKennedaleFY25AdoptedBudget

P. 83

OVERVIEW: DEBT SERVICE FUND

The Debt Service Fund pays for Debt that is secured by ad valorem (property) taxes. Property

taxes account for over 99% of the Debt Service Fund revenues, with the remainder coming from

investment income.

As of the preparation of this budget, the Debt Service Fund had amassed approximately

$629,481 in unassigned fund balance, primarily due to property tax revenues being more than

what was needed to pay debt service requirements in prior years. This budget decreases the

Interest and Sinking portion of Ad Valorem taxes by $.002 per $100 valuation.

EXPENSES AND BOND RATING

All expenses from the Debt Service are related payments of principal and interest on debt and

related agent fees.

The City of Kennedale’s AA- bond rating was affirmed by S&P Global Ratings on August 13,

2024. At that time, the outlook was improved to “Positive” from “Stable.”

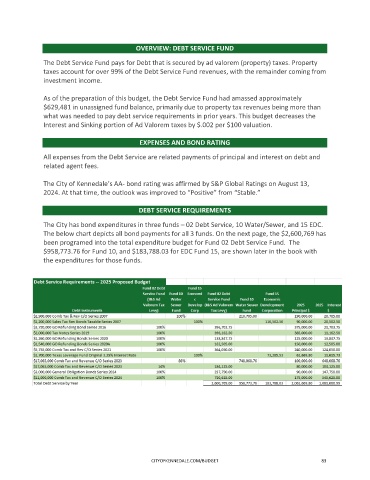

DEBT SERVICE REQUIREMENTS

The City has bond expenditures in three funds – 02 Debt Service, 10 Water/Sewer, and 15 EDC.

The below chart depicts all bond payments for all 3 funds. On the next page, the $2,600,769 has

been programed into the total expenditure budget for Fund 02 Debt Service Fund. The

$958,773.76 for Fund 10, and $183,788.03 for EDC Fund 15, are shown later in the book with

the expenditures for those funds.

CITYOFKENNEDALE.COM/BUDGET 83