Page 83 - CityofKellerFY25Budget

P. 83

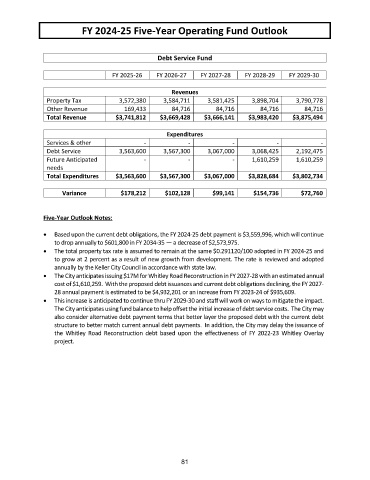

FY 2024-25 Five-Year Operating Fund Outlook

Debt Service Fund

FY 2025-26 FY 2026-27 FY 2027-28 FY 2028-29 FY 2029-30

Revenues

Property Tax 3,572,380 3,584,711 3,581,425 3,898,704 3,790,778

Other Revenue 169,433 84,716 84,716 84,716 84,716

Total Revenue $3,741,812 $3,669,428 $3,666,141 $3,983,420 $3,875,494

Expenditures

Services & other - - - - -

Debt Service 3,563,600 3,567,300 3,067,000 3,068,425 2,192,475

Future Anticipated - - - 1,610,259 1,610,259

needs

Total Expenditures $3,563,600 $3,567,300 $3,067,000 $3,828,684 $3,802,734

Variance $178,212 $102,128 $99,141 $154,736 $72,760

Five-Year Outlook Notes:

Based upon the current debt obligations, the FY 2024-25 debt payment is $3,559,996, which will continue

to drop annually to $601,800 in FY 2034-35 — a decrease of $2,573,975.

The total property tax rate is assumed to remain at the same $0.291120/100 adopted in FY 2024-25 and

to grow at 2 percent as a result of new growth from development. The rate is reviewed and adopted

annually by the Keller City Council in accordance with state law.

The City anticipates issuing $17M for Whitley Road Reconstruction in FY 2027-28 with an estimated annual

cost of $1,610,259. With the proposed debt issuances and current debt obligations declining, the FY 2027-

28 annual payment is estimated to be $4,932,201 or an increase from FY 2023-24 of $935,609.

This increase is anticipated to continue thru FY 2029-30 and staff will work on ways to mitigate the impact.

The City anticipates using fund balance to help offset the initial increase of debt service costs. The City may

also consider alternative debt payment terms that better layer the proposed debt with the current debt

structure to better match current annual debt payments. In addition, the City may delay the issuance of

the Whitley Road Reconstruction debt based upon the effectiveness of FY 2022-23 Whitley Overlay

project.

81