Page 78 - CityofKellerFY25Budget

P. 78

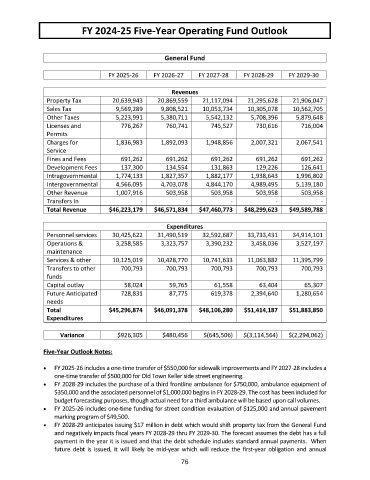

FY 2024-25 Five-Year Operating Fund Outlook

General Fund

FY 2025-26 FY 2026-27 FY 2027-28 FY 2028-29 FY 2029-30

Revenues

Property Tax 20,639,943 20,869,559 21,117,094 21,295,628 21,906,047

Sales Tax 9,569,289 9,808,521 10,053,734 10,305,078 10,562,705

Other Taxes 5,223,991 5,380,711 5,542,132 5,708,396 5,879,648

Licenses and 776,267 760,741 745,527 730,616 716,004

Permits

Charges for 1,836,983 1,892,093 1,948,856 2,007,321 2,067,541

Service

Fines and Fees 691,262 691,262 691,262 691,262 691,262

Development Fees 137,300 134,554 131,863 129,226 126,641

Intragovernmental 1,774,133 1,827,357 1,882,177 1,938,643 1,996,802

Intergovernmental 4,566,095 4,703,078 4,844,170 4,989,495 5,139,180

Other Revenue 1,007,916 503,958 503,958 503,958 503,958

Transfers In - - - - -

Total Revenue $46,223,179 $46,571,834 $47,460,773 $48,299,623 $49,589,788

Expenditures

Personnel services 30,425,622 31,490,519 32,592,687 33,733,431 34,914,101

Operations & 3,258,585 3,323,757 3,390,232 3,458,036 3,527,197

maintenance

Services & other 10,125,019 10,428,770 10,741,633 11,063,882 11,395,799

Transfers to other 700,793 700,793 700,793 700,793 700,793

funds

Capital outlay 58,024 59,765 61,558 63,404 65,307

Future Anticipated 728,831 87,775 619,378 2,394,640 1,280,654

needs

Total $45,296,874 $46,091,378 $48,106,280 $51,414,187 $51,883,850

Expenditures

Variance $926,305 $480,456 $(645,506) $(3,114,564) $(2,294,062)

Five-Year Outlook Notes:

FY 2025-26 includes a one-time transfer of $550,000 for sidewalk improvements and FY 2027-28 includes a

one-time transfer of $500,000 for Old Town Keller side street engineering.

FY 2028-29 includes the purchase of a third frontline ambulance for $750,000, ambulance equipment of

$350,000 and the associated personnel of $1,000,000 begins in FY 2028-29. The cost has been included for

budget forecasting purposes, though actual need for a third ambulance will be based upon call volumes.

FY 2025-26 includes one-time funding for street condition evaluation of $125,000 and annual pavement

marking program of $49,500.

FY 2028-29 anticipates issuing $17 million in debt which would shift property tax from the General Fund

and negatively impacts fiscal years FY 2028-29 thru FY 2029-30. The forecast assumes the debt has a full

payment in the year it is issued and that the debt schedule includes standard annual payments. When

future debt is issued, it will likely be mid-year which will reduce the first-year obligation and annual

76