Page 85 - CityofKellerFY25Budget

P. 85

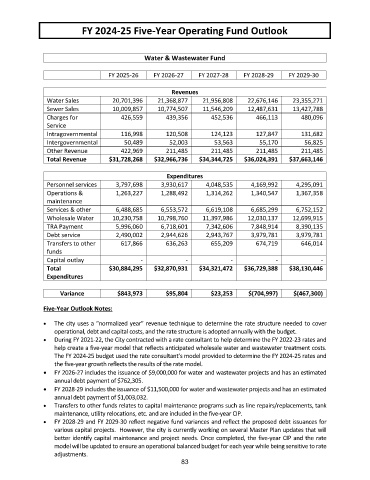

FY 2024-25 Five-Year Operating Fund Outlook

Water & Wastewater Fund

FY 2025-26 FY 2026-27 FY 2027-28 FY 2028-29 FY 2029-30

Revenues

Water Sales 20,701,396 21,368,877 21,956,808 22,676,146 23,355,271

Sewer Sales 10,009,857 10,774,507 11,546,209 12,487,631 13,427,788

Charges for 426,559 439,356 452,536 466,113 480,096

Service

Intragovernmental 116,998 120,508 124,123 127,847 131,682

Intergovernmental 50,489 52,003 53,563 55,170 56,825

Other Revenue 422,969 211,485 211,485 211,485 211,485

Total Revenue $31,728,268 $32,966,736 $34,344,725 $36,024,391 $37,663,146

Expenditures

Personnel services 3,797,698 3,930,617 4,048,535 4,169,992 4,295,091

Operations & 1,263,227 1,288,492 1,314,262 1,340,547 1,367,358

maintenance

Services & other 6,488,685 6,553,572 6,619,108 6,685,299 6,752,152

Wholesale Water 10,230,758 10,798,760 11,397,986 12,030,137 12,699,915

TRA Payment 5,996,060 6,718,601 7,342,606 7,848,914 8,390,135

Debt service 2,490,002 2,944,626 2,943,767 3,979,781 3,979,781

Transfers to other 617,866 636,263 655,209 674,719 646,014

funds

Capital outlay - - - - -

Total $30,884,295 $32,870,931 $34,321,472 $36,729,388 $38,130,446

Expenditures

Variance $843,973 $95,804 $23,253 $(704,997) $(467,300)

Five-Year Outlook Notes:

The city uses a “normalized year” revenue technique to determine the rate structure needed to cover

operational, debt and capital costs, and the rate structure is adopted annually with the budget.

During FY 2021-22, the City contracted with a rate consultant to help determine the FY 2022-23 rates and

help create a five-year model that reflects anticipated wholesale water and wastewater treatment costs.

The FY 2024-25 budget used the rate consultant’s model provided to determine the FY 2024-25 rates and

the five-year growth reflects the results of the rate model.

FY 2026-27 includes the issuance of $9,000,000 for water and wastewater projects and has an estimated

annual debt payment of $762,305.

FY 2028-29 includes the issuance of $11,500,000 for water and wastewater projects and has an estimated

annual debt payment of $1,003,032.

Transfers to other funds relates to capital maintenance programs such as line repairs/replacements, tank

maintenance, utility relocations, etc. and are included in the five-year CIP.

FY 2028-29 and FY 2029-30 reflect negative fund variances and reflect the proposed debt issuances for

various capital projects. However, the city is currently working on several Master Plan updates that will

better identify capital maintenance and project needs. Once completed, the five-year CIP and the rate

model will be updated to ensure an operational balanced budget for each year while being sensitive to rate

adjustments.

83