Page 49 - HaltomCityFY25Budget

P. 49

City Of Haltom City Annual Budget, FY2025 Budget Overview

MAJOR REVENUES

PROPERTY TAX

The City’s property tax is levied based on appraised value of property as determined by the Tarrant County

Appraisal District. The Tarrant County Tax Office bills and collects the property tax for the City.

The tax rate is $0.580727 per $100 assessed valuation, which consists of $0.386103 for maintenance and

operations cost (recorded in the General Fund) and $0.194624 for principal and interest payments on bond

indebtedness (recorded in the Debt Service Fund).

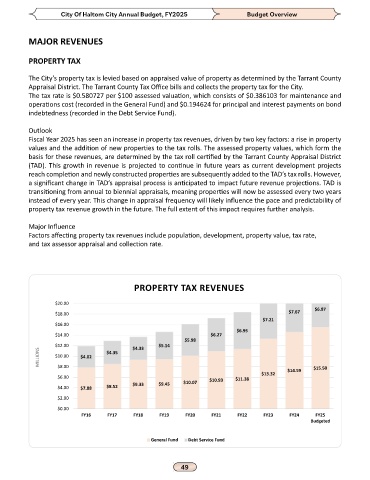

Outlook

Fiscal Year 2025 has seen an increase in property tax revenues, driven by two key factors: a rise in property

values and the addition of new properties to the tax rolls. The assessed property values, which form the

basis for these revenues, are determined by the tax roll certified by the Tarrant County Appraisal District

(TAD). This growth in revenue is projected to continue in future years as current development projects

reach completion and newly constructed properties are subsequently added to the TAD’s tax rolls. However,

a significant change in TAD’s appraisal process is anticipated to impact future revenue projections. TAD is

transitioning from annual to biennial appraisals, meaning properties will now be assessed every two years

instead of every year. This change in appraisal frequency will likely influence the pace and predictability of

property tax revenue growth in the future. The full extent of this impact requires further analysis.

Major Influence

Factors affecting property tax revenues include population, development, property value, tax rate,

and tax assessor appraisal and collection rate.

PROPERTY TAX REVENUES

$20.00

$6.87

$18.00 $7.67

$7.21

$16.00

$6.95

$14.00 $6.27

$5.98

$12.00 $4.33 $5.14

MILLIONS $10.00 $4.02 $4.35

$8.00

$13.32 $14.59 $15.50

$6.00 $10.07 $10.93 $11.38

$4.00 $7.88 $8.52 $9.33 $9.45

$2.00

$0.00

FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25

Budgeted

General Fund Debt Service Fund