Page 221 - City of Fort Worth Budget Book

P. 221

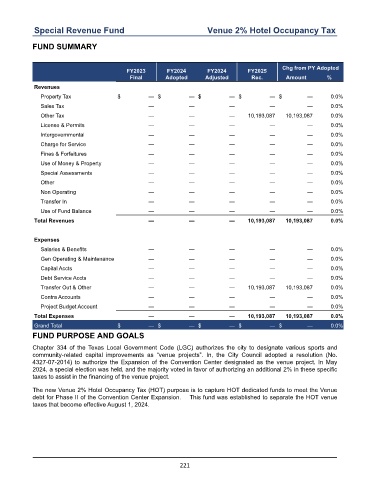

Special Revenue Fund Venue 2% Hotel Occupancy Tax

FUND SUMMARY

Chg from PY Adopted

FY2023 FY2024 FY2024 FY2025

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ — $ — $ — $ — $ — 0.0 %

Sales Tax — — — — — 0.0 %

Other Tax — — — 10,193,087 10,193,087 0.0 %

License & Permits — — — — — 0.0 %

Intergovernmental — — — — — 0.0 %

Charge for Service — — — — — 0.0 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money & Property — — — — — 0.0 %

Special Assessments — — — — — 0.0 %

Other — — — — — 0.0 %

Non Operating — — — — — 0.0 %

Transfer In — — — — — 0.0 %

Use of Fund Balance — — — — — 0.0 %

Total Revenues — — — 10,193,087 10,193,087 0.0 %

Expenses

Salaries & Benefits — — — — — 0.0 %

Gen Operating & Maintenance — — — — — 0.0 %

Capital Accts — — — — — 0.0 %

Debt Service Accts — — — — — 0.0 %

Transfer Out & Other — — — 10,193,087 10,193,087 0.0 %

Contra Accounts — — — — — 0.0 %

Project Budget Account — — — — — 0.0 %

Total Expenses — — — 10,193,087 10,193,087 0.0 %

Grand Total $ — $ — $ — $ — $ — 0.0 %

FUND PURPOSE AND GOALS

Chapter 334 of the Texas Local Government Code (LGC) authorizes the city to designate various sports and

community-related capital improvements as “venue projects”. In, the City Council adopted a resolution (No.

4327-07-2014) to authorize the Expansion of the Convention Center designated as the venue project. In May

2024, a special election was held, and the majority voted in favor of authorizing an additional 2% in these specific

taxes to assist in the financing of the venue project.

The new Venue 2% Hotel Occupancy Tax (HOT) purpose is to capture HOT dedicated funds to meet the Venue

debt for Phase II of the Convention Center Expansion. This fund was established to separate the HOT venue

taxes that become effective August 1, 2024.

221