Page 7 - Report

P. 7

Budget Process

Each department director determines departmental needs and enters and reviews them with the City

Administrator. The City Administrator reviews the budget with the Mayor before submitting it to the City

Council. Budget workshops are held as needed. The Council adopts the budget by ordinance. Budget

amendments are made only as necessary and upon approval by the Council via ordinance.

The FY 2024-2025 budget process will incorporate community input from workshops and public hearings.

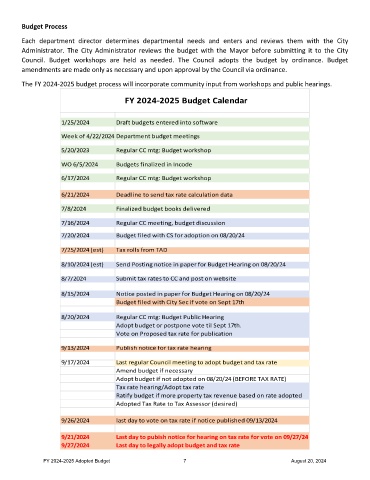

FY 2024-2025 Budget Calendar

1/25/2024 Draft budgets entered into software

Week of 4/22/2024 Department budget meetings

5/20/2023 Regular CC mtg: Budget workshop

WO 6/5/2024 Budgets finalized in Incode

6/17/2024 Regular CC mtg: Budget workshop

6/21/2024 Deadline to send tax rate calculation data

7/8/2024 Finalized budget books delivered

7/16/2024 Regular CC meeting, budget discussion

7/20/2024 Budget filed with CS for adoption on 08/20/24

7/25/2024 (est) Tax rolls from TAD

8/10/2024 (est) Send Posting notice in paper for Budget Hearing on 08/20/24

8/7/2024 Submit tax rates to CC and post on website

8/15/2024 Notice posted in paper for Budget Hearing on 08/20/24

Budget filed with City Sec if vote on Sept 17th

8/20/2024 Regular CC mtg: Budget Public Hearing

Adopt budget or postpone vote til Sept 17th.

Vote on Proposed tax rate for publication

9/13/2024 Publish notice for tax rate hearing

9/17/2024 Last regular Council meeting to adopt budget and tax rate

Amend budget if necessary

Adopt budget if not adopted on 08/20/24 (BEFORE TAX RATE)

Tax rate hearing/Adopt tax rate

Ratify budget if more property tax revenue based on rate adopted

Adopted Tax Rate to Tax Assessor (desired)

9/26/2024 last day to vote on tax rate if notice published 09/13/2024

9/21/2024 Last day to pubish notice for hearing on tax rate for vote on 09/27/24

9/27/2024 Last day to legally adopt budget and tax rate

FY 2024-2025 Adopted Budget 7 August 20, 2024