Page 11 - Report

P. 11

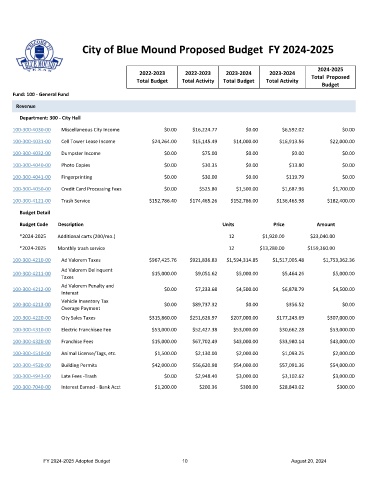

City of Blue Mound Proposed Budget FY 2024-2025

2024-2025

2022-2023 2022-2023 2023-2024 2023-2024

Total Budget Total Activity Total Budget Total Activity Total Proposed

Budget

Fund: 100 - General Fund

Revenue

Department: 300 - City Hall

100-300-4030-00 Miscellaneous City Income $0.00 $16,224.77 $0.00 $6,592.02 $0.00

100-300-4031-00 Cell Tower Lease Income $24,264.00 $15,145.49 $14,000.00 $16,913.56 $22,000.00

100-300-4032-00 Dumpster Income $0.00 $75.00 $0.00 $0.00 $0.00

100-300-4040-00 Photo Copies $0.00 $30.35 $0.00 $13.80 $0.00

100-300-4041-00 Fingerprinting $0.00 $30.00 $0.00 $119.79 $0.00

100-300-4050-00 Credit Card Processing Fees $0.00 $525.80 $1,500.00 $1,687.96 $1,700.00

100-300-4121-00 Trash Service $152,786.40 $174,465.26 $152,786.00 $136,465.98 $182,400.00

Budget Detail

Budget Code Description Units Price Amount

*2024-2025 Additional carts (200/mo.) 12 $1,920.00 $23,040.00

*2024-2025 Monthly trash service 12 $13,280.00 $159,360.00

100-300-4210-00 Ad Valorem Taxes $967,425.76 $921,836.83 $1,594,314.85 $1,517,005.48 $1,753,362.36

Ad Valorem Delinquent

100-300-4211-00 $15,000.00 $9,051.62 $5,000.00 $5,464.26 $5,000.00

Taxes

Ad Valorem Penalty and

100-300-4212-00 $0.00 $7,233.68 $4,500.00 $6,878.79 $4,500.00

Interest

Vehicle Inventory Tax

100-300-4213-00 $0.00 $89,737.32 $0.00 $356.52 $0.00

Overage Payment

100-300-4220-00 City Sales Taxes $315,860.00 $251,626.97 $207,000.00 $177,243.69 $307,000.00

100-300-4310-00 Electric Franchisee Fee $53,000.00 $52,427.38 $53,000.00 $30,662.28 $53,000.00

100-300-4320-00 Franchise Fees $15,000.00 $67,702.49 $43,000.00 $33,980.14 $43,000.00

100-300-4510-00 Animal License/Tags, etc. $1,500.00 $2,130.00 $2,000.00 $1,093.25 $2,000.00

100-300-4520-00 Building Permits $42,000.00 $56,620.98 $54,000.00 $57,091.36 $54,000.00

100-300-4943-00 Late Fees -Trash $0.00 $2,948.40 $3,000.00 $3,102.62 $3,000.00

100-300-7040-00 Interest Earned - Bank Acct $1,200.00 $200.36 $300.00 $28,843.02 $300.00

FY 2024-2025 Adopted Budget 10 August 20, 2024