Page 16 - CITY OF AZLE, TEXAS

P. 16

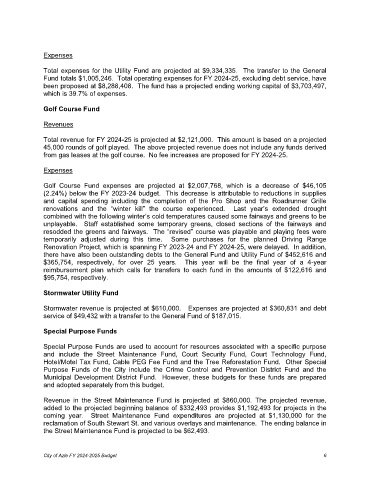

Expenses

Total expenses for the Utility Fund are projected at $9,334,335. The transfer to the General

Fund totals $1,005,246. Total operating expenses for FY 2024-25, excluding debt service, have

been proposed at $8,288,408. The fund has a projected ending working capital of $3,703,497,

which is 39.7% of expenses.

Golf Course Fund

Revenues

Total revenue for FY 2024-25 is projected at $2,121,000. This amount is based on a projected

45,000 rounds of golf played. The above projected revenue does not include any funds derived

from gas leases at the golf course. No fee increases are proposed for FY 2024-25.

Expenses

Golf Course Fund expenses are projected at $2,007,768, which is a decrease of $46,105

(2.24%) below the FY 2023-24 budget. This decrease is attributable to reductions in supplies

and capital spending including the completion of the Pro Shop and the Roadrunner Grille

renovations and the “winter kill” the course experienced. Last year’s extended drought

combined with the following winter’s cold temperatures caused some fairways and greens to be

unplayable. Staff established some temporary greens, closed sections of the fairways and

resodded the greens and fairways. The “revised” course was playable and playing fees were

temporarily adjusted during this time. Some purchases for the planned Driving Range

Renovation Project, which is spanning FY 2023-24 and FY 2024-25, were delayed. In addition,

there have also been outstanding debts to the General Fund and Utility Fund of $452,616 and

$365,754, respectively, for over 25 years. This year will be the final year of a 4-year

reimbursement plan which calls for transfers to each fund in the amounts of $122,616 and

$95,754, respectively.

Stormwater Utility Fund

Stormwater revenue is projected at $610,000. Expenses are projected at $360,831 and debt

service of $49,432 with a transfer to the General Fund of $187,015.

Special Purpose Funds

Special Purpose Funds are used to account for resources associated with a specific purpose

and include the Street Maintenance Fund, Court Security Fund, Court Technology Fund,

Hotel/Motel Tax Fund, Cable PEG Fee Fund and the Tree Reforestation Fund. Other Special

Purpose Funds of the City include the Crime Control and Prevention District Fund and the

Municipal Development District Fund. However, these budgets for these funds are prepared

and adopted separately from this budget.

Revenue in the Street Maintenance Fund is projected at $860,000. The projected revenue,

added to the projected beginning balance of $332,493 provides $1,192,493 for projects in the

coming year. Street Maintenance Fund expenditures are projected at $1,130,000 for the

reclamation of South Stewart St. and various overlays and maintenance. The ending balance in

the Street Maintenance Fund is projected to be $62,493.

City of Azle FY 2024-2025 Budget 6