Page 340 - FY 2025 Adopted Operating Budget and Business Plan

P. 340

Appendices Return to Table of Contents

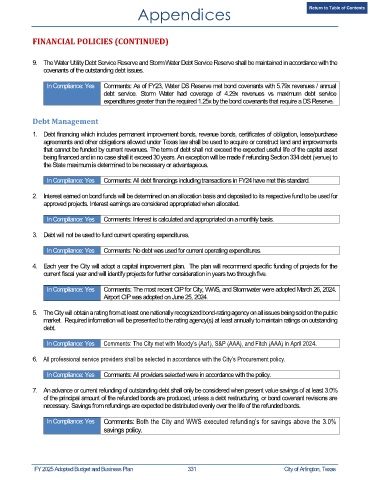

FINANCIAL POLICIES (CONTINUED)

9. The Water Utility Debt Service Reserve and Storm Water Debt Service Reserve shall be maintained in accordance with the

covenants of the outstanding debt issues.

In Compliance: Yes Comments: As of FY23, Water DS Reserve met bond covenants with 5.79x revenues / annual

debt service. Storm Water had coverage of 4.29x revenues vs maximum debt service

expenditures greater than the required 1.25x by the bond covenants that require a DS Reserve.

Debt Management

1. Debt financing which includes permanent improvement bonds, revenue bonds, certificates of obligation, lease/purchase

agreements and other obligations allowed under Texas law shall be used to acquire or construct land and improvements

that cannot be funded by current revenues. The term of debt shall not exceed the expected useful life of the capital asset

being financed and in no case shall it exceed 30 years. An exception will be made if refunding Section 334 debt (venue) to

the State maximum is determined to be necessary or advantageous.

In Compliance: Yes Comments: All debt financings including transactions in FY24 have met this standard.

2. Interest earned on bond funds will be determined on an allocation basis and deposited to its respective fund to be used for

approved projects. Interest earnings are considered appropriated when allocated.

In Compliance: Yes Comments: Interest is calculated and appropriated on a monthly basis.

3. Debt will not be used to fund current operating expenditures.

In Compliance: Yes Comments: No debt was used for current operating expenditures.

4. Each year the City will adopt a capital improvement plan. The plan will recommend specific funding of projects for the

current fiscal year and will identify projects for further consideration in years two through five.

In Compliance: Yes Comments: The most recent CIP for City, WWS, and Stormwater were adopted March 26, 2024.

Airport CIP was adopted on June 25, 2024.

5. The City will obtain a rating from at least one nationally recognized bond-rating agency on all issues being sold on the public

market. Required information will be presented to the rating agency(s) at least annually to maintain ratings on outstanding

debt.

In Compliance: Yes Comments: The City met with Moody’s (Aa1), S&P (AAA), and Fitch (AAA) in April 2024.

6. All professional service providers shall be selected in accordance with the City’s Procurement policy.

In Compliance: Yes Comments: All providers selected were in accordance with the policy.

7. An advance or current refunding of outstanding debt shall only be considered when present value savings of at least 3.0%

of the principal amount of the refunded bonds are produced, unless a debt restructuring, or bond covenant revisions are

necessary. Savings from refundings are expected be distributed evenly over the life of the refunded bonds.

In Compliance: Yes Comments: Both the City and WWS executed refunding’s for savings above the 3.0%

savings policy.

FY 2025 Adopted Budget and Business Plan 331 City of Arlington, Texas