Page 335 - FY 2025 Adopted Operating Budget and Business Plan

P. 335

Appendices Return to Table of Contents

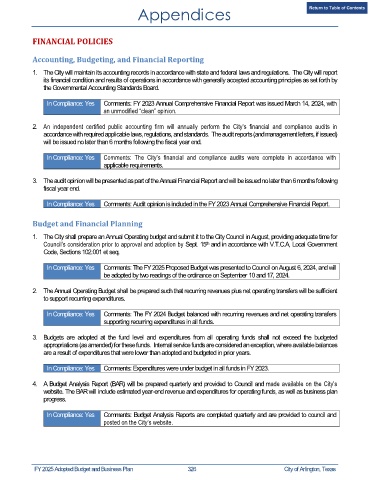

FINANCIAL POLICIES

Accounting, Budgeting, and Financial Reporting

1. The City will maintain its accounting records in accordance with state and federal laws and regulations. The City will report

its financial condition and results of operations in accordance with generally accepted accounting principles as set forth by

the Governmental Accounting Standards Board.

In Compliance: Yes Comments: FY 2023 Annual Comprehensive Financial Report was issued March 14, 2024, with

an unmodified “clean” opinion.

2. An independent certified public accounting firm will annually perform the City’s financial and compliance audits in

accordance with required applicable laws, regulations, and standards. The audit reports (and management letters, if issued)

will be issued no later than 6 months following the fiscal year end.

In Compliance: Yes Comments: The City’s financial and compliance audits were complete in accordance with

applicable requirements.

3. The audit opinion will be presented as part of the Annual Financial Report and will be issued no later than 6 months following

fiscal year end.

In Compliance: Yes Comments: Audit opinion is included in the FY 2023 Annual Comprehensive Financial Report.

Budget and Financial Planning

1. The City shall prepare an Annual Operating budget and submit it to the City Council in August, providing adequate time for

Council’s consideration prior to approval and adoption by Sept. 15 and in accordance with V.T.C.A, Local Government

th

Code, Sections 102.001 et seq.

In Compliance: Yes Comments: The FY 2025 Proposed Budget was presented to Council on August 6, 2024, and will

be adopted by two readings of the ordinance on September 10 and 17, 2024.

2. The Annual Operating Budget shall be prepared such that recurring revenues plus net operating transfers will be sufficient

to support recurring expenditures.

In Compliance: Yes Comments: The FY 2024 Budget balanced with recurring revenues and net operating transfers

supporting recurring expenditures in all funds.

3. Budgets are adopted at the fund level and expenditures from all operating funds shall not exceed the budgeted

appropriations (as amended) for these funds. Internal service funds are considered an exception, where available balances

are a result of expenditures that were lower than adopted and budgeted in prior years.

In Compliance: Yes Comments: Expenditures were under budget in all funds in FY 2023.

4. A Budget Analysis Report (BAR) will be prepared quarterly and provided to Council and made available on the City’s

website. The BAR will include estimated year-end revenue and expenditures for operating funds, as well as business plan

progress.

In Compliance: Yes Comments: Budget Analysis Reports are completed quarterly and are provided to council and

posted on the City’s website.

FY 2025 Adopted Budget and Business Plan 326 City of Arlington, Texas