Page 64 - Southlake FY24 Budget

P. 64

Forecast Revenues

Forecasting these key revenues correctly and conservatively is critical to ensuring the budget is balanced

for the coming fiscal year and for the health of future budgets. In addition to preparing a forecast prior

to the adoption of the annual budget, the City of Southlake continually forecasts throughout the year as

trends in the market, economy, or other environmental factors are observed.

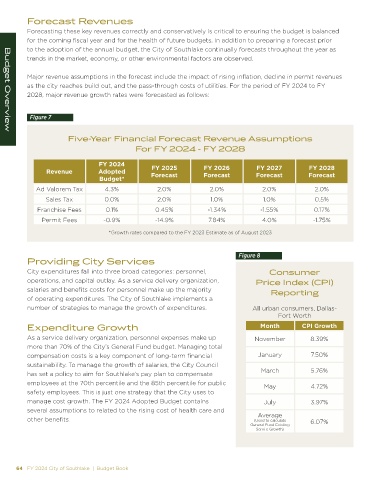

Major revenue assumptions in the forecast include the impact of rising inflation, decline in permit revenues

as the city reaches build out, and the pass-through costs of utilities. For the period of FY 2024 to FY

2028, major revenue growth rates were forecasted as follows:

Figure 7

Budget Overview

Five-Year Financial Forecast Revenue Assumptions

For FY 2024 - FY 2028

FY 2024

FY 2025

Revenue Adopted Forecast FY 2026 FY 2027 FY 2028

Forecast

Forecast

Forecast

Budget*

Ad Valorem Tax 4.3% 2.0% 2.0% 2.0% 2.0%

Sales Tax 0.0% 2.0% 1.0% 1.0% 0.5%

Franchise Fees 0.1% 0.45% -1.34% -1.55% 0.17%

Permit Fees -0.9% -14.9% 7.84% 4.0% -1.75%

*Growth rates compared to the FY 2023 Estimate as of August 2023

Figure 8

Providing City Services

City expenditures fall into three broad categories: personnel, Consumer

operations, and capital outlay. As a service delivery organization, Price Index (CPI)

salaries and benefits costs for personnel make up the majority Reporting

of operating expenditures. The City of Southlake implements a

number of strategies to manage the growth of expenditures. All urban consumers, Dallas-

Fort Worth

Expenditure Growth Month CPI Growth

As a service delivery organization, personnel expenses make up November 8.39%

more than 70% of the City’s General Fund budget. Managing total

compensation costs is a key component of long-term financial January 7.50%

sustainability. To manage the growth of salaries, the City Council

has set a policy to aim for Southlake’s pay plan to compensate March 5.76%

employees at the 70th percentile and the 85th percentile for public May 4.72%

safety employees. This is just one strategy that the City uses to

manage cost growth. The FY 2024 Adopted Budget contains July 3.97%

several assumptions to related to the rising cost of health care and

Average

other benefits. (Used to calculate 6.07%

General Fund Existing

Servi e Growth)

64 FY 2024 City of Southlake | Budget Book