Page 63 - Southlake FY24 Budget

P. 63

City Revenues and Resources

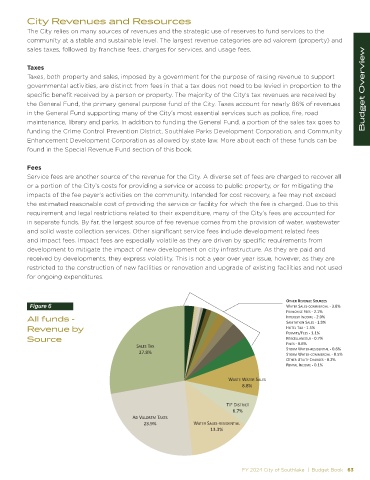

The City relies on many sources of revenues and the strategic use of reserves to fund services to the

community at a stable and sustainable level. The largest revenue categories are ad valorem (property) and

sales taxes, followed by franchise fees, charges for services, and usage fees.

Taxes

Taxes, both property and sales, imposed by a government for the purpose of raising revenue to support

governmental activities, are distinct from fees in that a tax does not need to be levied in proportion to the Budget Overview

specific benefit received by a person or property. The majority of the City’s tax revenues are received by

the General Fund, the primary general purpose fund of the City. Taxes account for nearly 86% of revenues

in the General Fund supporting many of the City’s most essential services such as police, fire, road

maintenance, library and parks. In addition to funding the General Fund, a portion of the sales tax goes to

funding the Crime Control Prevention District, Southlake Parks Development Corporation, and Community

Enhancement Development Corporation as allowed by state law. More about each of these funds can be

found in the Special Revenue Fund section of this book.

Fees

Service fees are another source of the revenue for the City. A diverse set of fees are charged to recover all

or a portion of the City’s costs for providing a service or access to public property, or for mitigating the

impacts of the fee payer’s activities on the community. Intended for cost recovery, a fee may not exceed

the estimated reasonable cost of providing the service or facility for which the fee is charged. Due to this

requirement and legal restrictions related to their expenditure, many of the City’s fees are accounted for

in separate funds. By far, the largest source of fee revenue comes from the provision of water, wastewater

and solid waste collection services. Other significant service fees include development related fees

and impact fees. Impact fees are especially volatile as they are driven by specific requirements from

development to mitigate the impact of new development on city infrastructure. As they are paid and

received by developments, they express volatility. This is not a year over year issue, however, as they are

restricted to the construction of new facilities or renovation and upgrade of existing facilities and not used

for ongoing expenditures.

OTHER REVENUE SOURCES

Figure 6 WATER SALES-COMMERCIAL - 3.8%

FRANCHISE FEES - 2.1%

All funds - INTEREST INCOME - 2.0%

SANITATION SALES - 1.9%

Revenue by HOTEL TAX - 1.5%

PERMITS/FEES - 1.1%

Source MISCELLANEOUS - 0.7%

SALES TAX FINES - 0.6%

STORM WATER-RESIDENTIAL - 0.6%

27.8% STORM WATER-COMMERCIAL - 0.5%

OTHER UTILITY CHARGES - 0.2%

RENTAL INCOME - 0.1%

WASTE WATER SALES

8.8%

TIF DISTRICT

6.7%

AD VALOREM TAXES

23.9% WATER SALES-RESIDENTIAL

13.3%

FY 2024 City of Southlake | Budget Book 63