Page 23 - Southlake FY24 Budget

P. 23

General Fund Revenue by Source

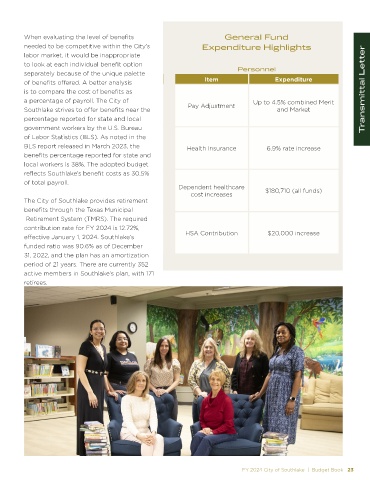

When evaluating the level of benefits General Fund

needed to be competitive within the City’s Expenditure Highlights

labor market, it would be inappropriate

to look at each individual benefit option

separately because of the unique palette Personnel

of benefits offered. A better analysis Item Expenditure

is to compare the cost of benefits as Transmittal Letter

a percentage of payroll. The City of Up to 4.5% combined Merit

Southlake strives to offer benefits near the Pay Adjustment and Market

percentage reported for state and local

government workers by the U.S. Bureau

of Labor Statistics (BLS). As noted in the

BLS report released in March 2023, the Health Insurance 6.9% rate increase

benefits percentage reported for state and

local workers is 38%. The adopted budget

reflects Southlake’s benefit costs as 30.5%

of total payroll.

Dependent healthcare $180,710 (all funds)

cost increases

The City of Southlake provides retirement

benefits through the Texas Municipal

Retirement System (TMRS). The required

contribution rate for FY 2024 is 12.72%,

effective January 1, 2024. Southlake’s HSA Contribution $20,000 increase

funded ratio was 90.6% as of December

31, 2022, and the plan has an amortization

period of 21 years. There are currently 352

active members in Southlake’s plan, with 171

retirees.

FY 2024 City of Southlake | Budget Book 23