Page 20 - Southlake FY24 Budget

P. 20

State law requires a taxing unit to calculate two rates after receiving its certified appraisal - roll the

no-new-revenue tax rate and the voter-approval tax rate. The no-new-revenue rate is the rate that will

generate the same amount of property tax dollars as the previous year when the two years are compared,

excluding new construction and annexations.

If a city adopts a tax rate exceeding the voter-approval rate, then the city must hold an automatic election.

Depending on the ultimate rate that is chosen by the city and its relationship to these legally defined rates,

there are requirements that must be followed to comply with truth-in-taxation laws. These requirements

protect the public’s right-to-know concerning tax rate decisions.

Transmittal Letter

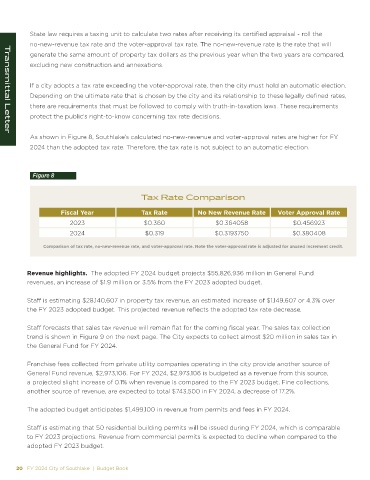

As shown in Figure 8, Southlake’s calculated no-new-revenue and voter-approval rates are higher for FY

2024 than the adopted tax rate. Therefore, the tax rate is not subject to an automatic election.

Figure 8

Tax Rate Comparison

Fiscal Year Tax Rate No New Revenue Rate Voter Approval Rate

2023 $0.360 $0.364058 $0.456923

2024 $0.319 $0.3193750 $0.380408

Comparison of tax rate, no-new-revenue rate, and voter-approval rate. Note the voter-approval rate is adjusted for unused increment credit.

Revenue highlights. The adopted FY 2024 budget projects $55,826,936 million in General Fund

revenues, an increase of $1.9 million or 3.5% from the FY 2023 adopted budget.

Staff is estimating $28,140,607 in property tax revenue, an estimated increase of $1,149,607 or 4.3% over

the FY 2023 adopted budget. This projected revenue reflects the adopted tax rate decrease.

Staff forecasts that sales tax revenue will remain flat for the coming fiscal year. The sales tax collection

trend is shown in Figure 9 on the next page. The City expects to collect almost $20 million in sales tax in

the General Fund for FY 2024.

Franchise fees collected from private utility companies operating in the city provide another source of

General Fund revenue, $2,973,106. For FY 2024, $2,973,106 is budgeted as a revenue from this source,

a projected slight increase of 0.1% when revenue is compared to the FY 2023 budget. Fine collections,

another source of revenue, are expected to total $743,500 in FY 2024, a decrease of 17.2%.

The adopted budget anticipates $1,499,100 in revenue from permits and fees in FY 2024.

Staff is estimating that 50 residential building permits will be issued during FY 2024, which is comparable

to FY 2023 projections. Revenue from commercial permits is expected to decline when compared to the

adopted FY 2023 budget.

20 FY 2024 City of Southlake | Budget Book