Page 19 - Southlake FY24 Budget

P. 19

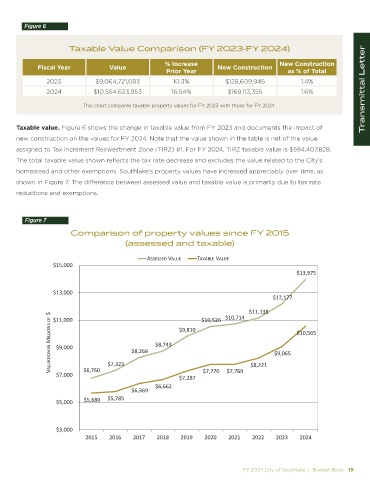

Figure 6

Taxable Value Comparison (FY 2023-FY 2024)

% Increase New Construction

Fiscal Year Value New Construction

Prior Year as % of Total

2023 $9,064,721,083 10.3% $128,609,945 1.4%

2024 $10,564,623,953 16.54% $169,113,355 1.6% Transmittal Letter

This chart compares taxable property values for FY 2023 with those for FY 2024.

Taxable value. Figure 6 shows the change in taxable value from FY 2023 and documents the impact of

new construction on the values for FY 2024. Note that the value shown in the table is net of the value

assigned to Tax Increment Reinvestment Zone (TIRZ) #1. For FY 2024, TIRZ taxable value is $594,407,828.

The total taxable value shown reflects the tax rate decrease and excludes the value related to the City’s

homestead and other exemptions. Southlake’s property values have increased appreciably over time, as

shown in Figure 7. The difference between assessed value and taxable value is primarily due to tax rate

reductions and exemptions.

Figure 7

Comparison of property values since FY 2015

(assessed and taxable)

ASSESSED VALUE TAXABLE VALUE

$15,000

$13,975

$13,000

$12,177

$11,138

VALUATION IN MILLIONS OF $ $9,000 $8,269 $8,743 $9,810 $9,065 $10,565

$10,714

$10,526

$11,000

$7,000 $6,760 $7,323 $7,287 $7,770 $7,769 $8,221

$6,662

$6,369

$5,000 $5,680 $5,785

$3,000

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

FY 2024 City of Southlake | Budget Book 19