Page 109 - Southlake FY24 Budget

P. 109

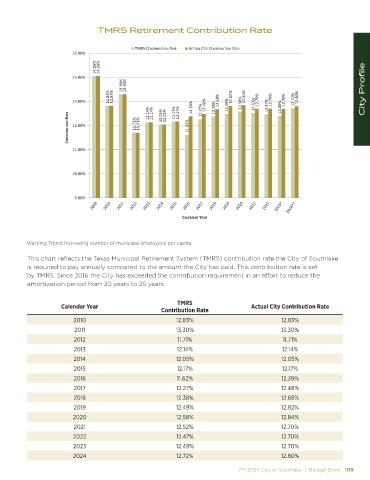

TMRS Retirement Contribution Rate

TMRS CONTRIBUTION RATE ACTUAL CITY CONTRIBUTION RATE

15.00%

14.06% 14.06%

14.00%

13.30% 13.30% City Profile

12.83% 12.83% 12.82% 12.84% 12.80%

13.00% 12.14% 12.14% 12.17% 12.17% 12.39% 12.27% 12.48% 12.38% 12.68% 12.49% 12.58% 12.52% 12.70% 12.47% 12.70% 12.40% 12.70% 12.72%

CONTRIBUTION RATE 12.00% 11.71% 11.71% 12.05% 12.05% 11.62%

11.00%

10.00%

9.00%

CALENDAR YEAR

Warning Trend: Increasing number of municipal employees per capita

This chart reflects the Texas Municipal Retirement System (TMRS) contribution rate the City of Southlake

is required to pay annually compared to the amount the City has paid. This contribution rate is set

by TMRS. Since 2016 the City has exceeded the contribution requirement in an effort to reduce the

amortization period from 30 years to 25 years.

TMRS

Calendar Year Actual City Contribution Rate

Contribution Rate

2010 12.83% 12.83%

2011 13.30% 13.30%

2012 11.71% 11.71%

2013 12.14% 12.14%

2014 12.05% 12.05%

2015 12.17% 12.17%

2016 11.62% 12.39%

2017 12.27% 12.48%

2018 12.38% 12.68%

2019 12.49% 12.82%

2020 12.58% 12.84%

2021 12.52% 12.70%

2022 12.47% 12.70%

2023 12.49% 12.70%

2024 12.72% 12.80%

FY 2024 City of Southlake | Budget Book 109