Page 112 - Southlake FY24 Budget

P. 112

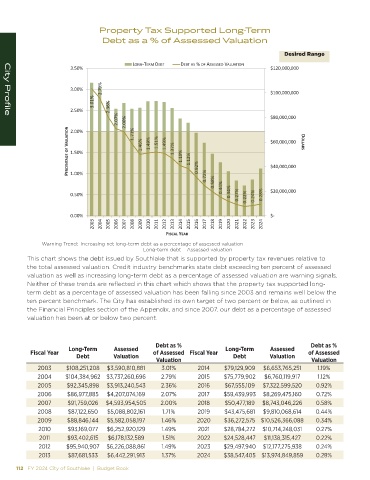

Property Tax Supported Long-Term

Debt as a % of Assessed Valuation

Desired Range

LONG-TERM DEBT DEBT AS % OF ASSESSED VALUATION

3.50% $120,000,000

2.79% $100,000,000

3.00%

3.01%

2.50% 2.36%

2.07% 2.00% 1.71% $80,000,000

City Profile

PERCENTAGE OF VALUATION 1.50% 1.46% 1.49% 1.51% 1.49% 1.37% 1.19% 1.12% $60,000,000 DOLLARS

2.00%

0.72% 0.92% 0.58% $40,000,000

1.00%

0.50% 0.44% 0.34% 0.27% 0.22% 0.24% 0.28% $20,000,000

0.00% $-

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

FISCAL YEAR

Warning Trend: Increasing net long-term debt as a percentage of assessed valuation

Long-term debt Assessed valuation

This chart shows the debt issued by Southlake that is supported by property tax revenues relative to

the total assessed valuation. Credit industry benchmarks state debt exceeding ten percent of assessed

valuation as well as increasing long-term debt as a percentage of assessed valuation are warning signals.

Neither of these trends are reflected in this chart which shows that the property tax supported long-

term debt as a percentage of assessed valuation has been falling since 2003 and remains well below the

ten percent benchmark. The City has established its own target of two percent or below, as outlined in

the Financial Principles section of the Appendix, and since 2007, our debt as a percentage of assessed

valuation has been at or below two percent.

Debt as % Debt as %

Long-Term Assessed Long-Term Assessed

Fiscal Year of Assessed Fiscal Year of Assessed

Debt Valuation Debt Valuation

Valuation Valuation

2003 $108,251,208 $3,590,810,881 3.01% 2014 $79,129,909 $6,653,765,251 1.19%

2004 $104,384,962 $3,737,260,696 2.79% 2015 $75,779,902 $6,760,119,917 1.12%

2005 $92,345,898 $3,913,240,543 2.36% 2016 $67,555,109 $7,322,599,520 0.92%

2006 $86,977,885 $4,207,074,169 2.07% 2017 $59,439,993 $8,269,475,160 0.72%

2007 $91,759,026 $4,593,954,505 2.00% 2018 $50,477,189 $8,743,046,226 0.58%

2008 $87,122,650 $5,088,802,161 1.71% 2019 $43,475,681 $9,810,068,614 0.44%

2009 $88,846,144 $5,582,058,197 1.46% 2020 $36,272,575 $10,526,366,088 0.34%

2010 $93,169,077 $6,252,920,129 1.49% 2021 $28,784,272 $10,714,248,031 0.27%

2011 $93,402,615 $6,178,132,589 1.51% 2022 $24,528,447 $11,138,315,427 0.22%

2012 $95,940,907 $6,226,088,861 1.49% 2023 $29,497,940 $12,177,275,938 0.24%

2013 $87,681,533 $6,442,291,913 1.37% 2024 $38,547,405 $13,974,849,859 0.28%

112 FY 2024 City of Southlake | Budget Book