Page 65 - CityofMansfieldFY24Budget

P. 65

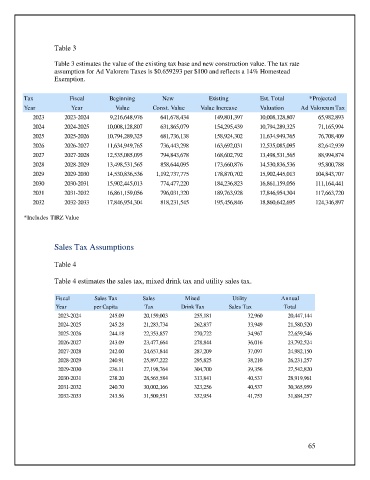

Table 3

Table 3 estimates the value of the existing tax base and new construction value. The tax rate

assumption for Ad Valorem Taxes is $0.659293 per $100 and reflects a 14% Homestead

Exemption.

Tax Fiscal Beginning New Existing Est. Total *Projected

Year Year Value Const. Value Value Increase Valuation Ad Valoreum Tax

2023 2023-2024 9,216,648,976 641,678,434 149,801,397 10,008,128,807 65,982,893

2024 2024-2025 10,008,128,807 631,865,079 154,295,439 10,794,289,325 71,165,994

2025 2025-2026 10,794,289,325 681,736,138 158,924,302 11,634,949,765 76,708,409

2026 2026-2027 11,634,949,765 736,443,298 163,692,031 12,535,085,095 82,642,939

2027 2027-2028 12,535,085,095 794,843,678 168,602,792 13,498,531,565 88,994,874

2028 2028-2029 13,498,531,565 858,644,095 173,660,876 14,530,836,536 95,800,788

2029 2029-2030 14,530,836,536 1,192,737,775 178,870,702 15,902,445,013 104,843,707

2030 2030-2031 15,902,445,013 774,477,220 184,236,823 16,861,159,056 111,164,441

2031 2031-2032 16,861,159,056 796,031,320 189,763,928 17,846,954,304 117,663,720

2032 2032-2033 17,846,954,304 818,231,545 195,456,846 18,860,642,695 124,346,897

*Includes TIRZ Value

Sales Tax Assumptions

Table 4

Table 4 estimates the sales tax, mixed drink tax and utility sales tax.

Fiscal Sales Tax Sales Mixed Utility Annual

Year per Capita Tax Drink Tax Sales Tax Total

2023-2024 245.09 20,159,003 255,181 32,960 20,447,144

2024-2025 245.28 21,283,734 262,837 33,949 21,580,520

2025-2026 244.18 22,353,857 270,722 34,967 22,659,546

2026-2027 243.09 23,477,664 278,844 36,016 23,792,524

2027-2028 242.00 24,657,844 287,209 37,097 24,982,150

2028-2029 240.91 25,897,222 295,825 38,210 26,231,257

2029-2030 236.11 27,198,764 304,700 39,356 27,542,820

2030-2031 238.20 28,565,584 313,841 40,537 28,919,961

2031-2032 240.70 30,002,166 323,256 40,537 30,365,959

2032-2033 243.56 31,509,551 332,954 41,753 31,884,257

65