Page 64 - CityofMansfieldFY24Budget

P. 64

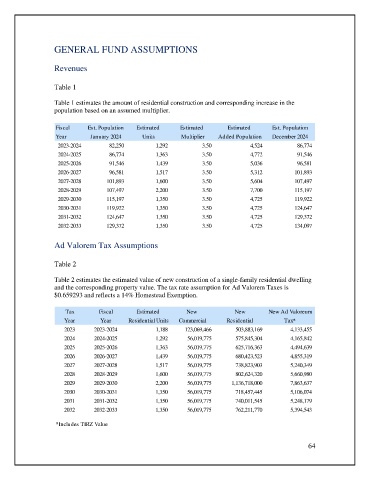

GENERAL FUND ASSUMPTIONS

Revenues

Table 1

Table 1 estimates the amount of residential construction and corresponding increase in the

population based on an assumed multiplier.

Fiscal Est. Population Estimated Estimated Estimated Est. Population

Year January 2024 Units Multiplier Added Population December 2024

2023-2024 82,250 1,292 3.50 4,524 86,774

2024-2025 86,774 1,363 3.50 4,772 91,546

2025-2026 91,546 1,439 3.50 5,036 96,581

2026-2027 96,581 1,517 3.50 5,312 101,893

2027-2028 101,893 1,600 3.50 5,604 107,497

2028-2029 107,497 2,200 3.50 7,700 115,197

2029-2030 115,197 1,350 3.50 4,725 119,922

2030-2031 119,922 1,350 3.50 4,725 124,647

2031-2032 124,647 1,350 3.50 4,725 129,372

2032-2033 129,372 1,350 3.50 4,725 134,097

Ad Valorem Tax Assumptions

Table 2

Table 2 estimates the estimated value of new construction of a single-family residential dwelling

and the corresponding property value. The tax rate assumption for Ad Valorem Taxes is

$0.659293 and reflects a 14% Homestead Exemption.

Tax Fiscal Estimated New New New Ad Valoreum

Year Year Residential Units Commercial Residential Tax*

2023 2023-2024 1,188 123,069,466 503,883,169 4,133,455

2024 2024-2025 1,292 56,019,775 575,845,304 4,165,842

2025 2025-2026 1,363 56,019,775 625,716,363 4,494,639

2026 2026-2027 1,439 56,019,775 680,423,523 4,855,319

2027 2027-2028 1,517 56,019,775 738,823,903 5,240,349

2028 2028-2029 1,600 56,019,775 802,624,320 5,660,980

2029 2029-2030 2,200 56,019,775 1,136,718,000 7,863,637

2030 2030-2031 1,350 56,019,775 718,457,445 5,106,074

2031 2031-2032 1,350 56,019,775 740,011,545 5,248,179

2032 2032-2033 1,350 56,019,775 762,211,770 5,394,543

*Includes TIRZ Value

64