Page 42 - CityofHaltomFY24Budget

P. 42

City Of Haltom City Annual Budget, Fy2024 Budget Overview City Of Haltom City Annual Budget, Fy2024 Budget Overview

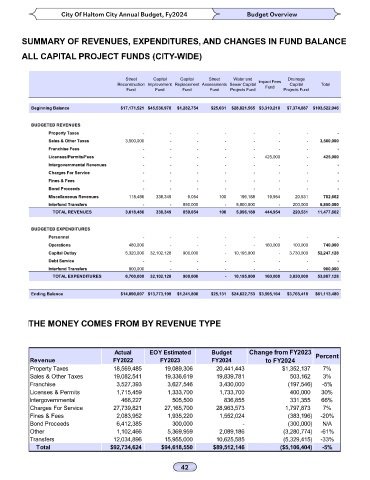

SUMMARY OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCE

MAJOR SOURCES OF REVENUES

ALL CAPITAL PROJECT FUNDS (CITY-WIDE)

Major sources of revenue are taxes, licenses and charges for operating services, and bond issues

for capital improvement funds.

Street Capital Capital Street Water and Drainage

Reconstruction Improvement Replacement Assessments Sewer Capital Impact Fees Capital Total

Fund Fund Fund Fund Projects Fund Fund Projects Fund

Taxes and Franchise include property tax, sales and use taxes, and franchise fees. Property

tax estimates are based on current property values, new construction, and the adopted tax

Beginning Balance $17,171,521 $45,536,978 $1,282,754 $25,031 $28,821,565 $3,310,210 $7,374,887 $103,522,946

rate. Estimates for sales and use taxes are adjusted according to the economic locally and

nationally. A more prudent and strategic approach to fiscal planning is necessary when possibly facing

BUDGETED REVENUES

Property Taxes - - - - - - - - economic uncertainties, particularly a recession. Property taxes are budgeted on values of properties

Sales & Other Taxes 3,500,000 - - - - - - 3,500,000 determined by the Tarrant County Appraisal District, the City’s tax rate, and the expected collection

Franchise Fees - - - - - - - - rate. New growth and the increased values from new developments adds to the City’s property

Licenses/Permits/Fees - - - - - 425,000 - 425,000 values and will continue to increase revenues while allowing tax rate reductions in this formula.

Intergovernmental Revenues - - - - - - - - Franchise taxes have been adjusted based on laws affecting telecommunications in past years.

Charges For Service - - - - - - - -

Fines & Fees - - - - - - - - Licenses & Permits, Charges for Services, Fines, and Fees include licenses, permits, charges

Bond Proceeds - - - - - - - - for services, and fines. Trend analysis and known new development projects are used to project

Miscellaneous Revenues 118,486 338,349 9,054 100 196,188 19,954 20,531 702,662 the charges for services.

Interfund Transfers - - 850,000 - 5,800,000 - 200,000 6,850,000

TOTAL REVENUES 3,618,486 338,349 859,054 100 5,996,188 444,954 220,531 11,477,662 Intergovernmental revenues are grants from other governmental entities. The City receives

grants for Streets, Police, Fire, Drainage, Parks, and Library.

BUDGETED EXPENDITURES

Personnel - - - - - - - - Other revenues are donations, interest income, and other miscellaneous revenues.

Operations 480,000 - - - - 160,000 100,000 740,000

Capital Outlay 5,320,000 32,102,128 900,000 - 10,195,000 - 3,730,000 52,247,128 Transfers are transactions between funds. Transfers include administrative fees, fleet service

Debt Service - - - - - - - - fees, debt service payments, and billing fees.

Interfund Transfers 900,000 - - - - - - 900,000

TOTAL EXPENDITURES 6,700,000 32,102,128 900,000 - 10,195,000 160,000 3,830,000 53,887,128

Bond Proceed are a way to raise funds for major capital projects and infrastructure improvements.

Ending Balance $14,090,007 $13,773,199 $1,241,808 $25,131 $24,622,753 $3,595,164 $3,765,418 $61,113,480 Although bond revenues show in the year they are received, repayment expenses can carry for

multiple years.

THE MONEY COMES FROM BY REVENUE TYPE

WHERE THE MONEY COMES FROM - BY REVENUE TYPE

FY2024 All funds Total Revenue $89,512,146 (By revenue type)

Actual EOY Estimated Budget Change from FY2023 Percent 35,000,000

Revenue FY2022 FY2023 FY2024 to FY2024 Charges For Service

Property Taxes 18,569,485 19,089,306 20,441,443 $1,352,137 7% 30,000,000 Sales & Other Taxes 28,963,573

Sales & Other Taxes 19,082,541 19,336,619 19,839,781 503,162 3% 19,839,781

Franchise 3,527,393 3,627,546 3,430,000 (197,546) -5% 25,000,000 Property Taxes

Licenses & Permits 1,715,459 1,333,700 1,733,700 400,000 30% 20,000,000 20,441,443

Intergovernmental 466,227 505,500 836,855 331,355 66%

Charges For Service 27,739,821 27,165,700 28,963,573 1,797,873 7% 15,000,000 Transfers

Fines & Fees 2,083,952 1,935,220 1,552,024 (383,196) -20% Licenses & Permits 10,625,585

Bond Proceeds 6,412,385 300,000 - (300,000) N/A 10,000,000 1,733,700

Other 1,102,466 5,369,959 2,089,186 (3,280,774) -61% 5,000,000 Franchise Fines & Fees Other

3,430,000

Transfers 12,034,896 15,955,000 10,625,585 (5,329,415) -33% Intergovernmental 1,552,024 Bond Proceeds 2,089,186

836,855

Total $92,734,624 $94,618,550 $89,512,146 ($5,106,404) -5% - -