Page 47 - GrapevineFY24 Adopted Budget

P. 47

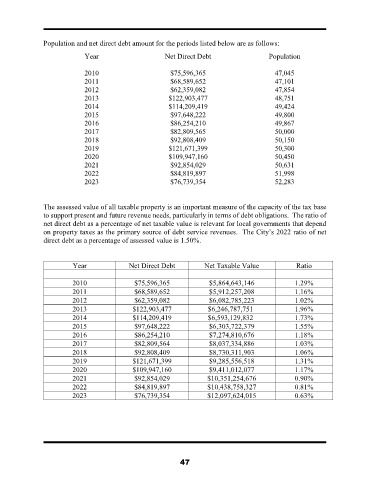

Population and net direct debt amount for the periods listed below are as follows:

Year Net Direct Debt Population

2010 $75,596,365 47,045

2011 $68,589,652 47,101

2012 $62,359,082 47,854

2013 $122,903,477 48,751

2014 $114,209,419 49,424

2015 $97,648,222 49,800

2016 $86,254,210 49,867

2017 $82,809,565 50,000

2018 $92,808,409 50,150

2019 $121,671,399 50,300

2020 $109,947,160 50,450

2021 $92,854,029 50,631

2022 $84,819,897 51,998

2023 $76,739,354 52,283

The assessed value of all taxable property is an important measure of the capacity of the tax base

to support present and future revenue needs, particularly in terms of debt obligations. The ratio of

net direct debt as a percentage of net taxable value is relevant for local governments that depend

on property taxes as the primary source of debt service revenues. The City’s 2022 ratio of net

direct debt as a percentage of assessed value is 1.50%.

Year Net Direct Debt Net Taxable Value Ratio

2010 $75,596,365 $5,864,643,146 1.29%

2011 $68,589,652 $5,912,257,208 1.16%

2012 $62,359,082 $6,082,785,223 1.02%

2013 $122,903,477 $6,246,787,751 1.96%

2014 $114,209,419 $6,593,129,832 1.73%

2015 $97,648,222 $6,303,722,379 1.55%

2016 $86,254,210 $7,274,810,676 1.18%

2017 $82,809,564 $8,037,334,886 1.03%

2018 $92,808,409 $8,730,311,903 1.06%

2019 $121,671,399 $9,285,556,518 1.31%

2020 $109,947,160 $9,411,012,077 1.17%

2021 $92,854,029 $10,351,254,676 0.90%

2022 $84,819,897 $10,438,758,327 0.81%

2023 $76,739,354 $12,097,624,015 0.63%

47